November is right around the corner which means one of the most polarizing elections in recent memory is upon us. In an effort to best serve you, we felt it was necessary to provide a guide to this years election, how it might affect the market, and what we are doing to position you for success!

Navigating The 2020 Election:

Election years have always had a funny impact on the markets, every little piece of news (and noise) is capable of sending the indexes up or down – and sometimes, up and down – violently. Even more acute is the impact election year dynamics have on investors’ emotional volatility; it’s almost blinding.

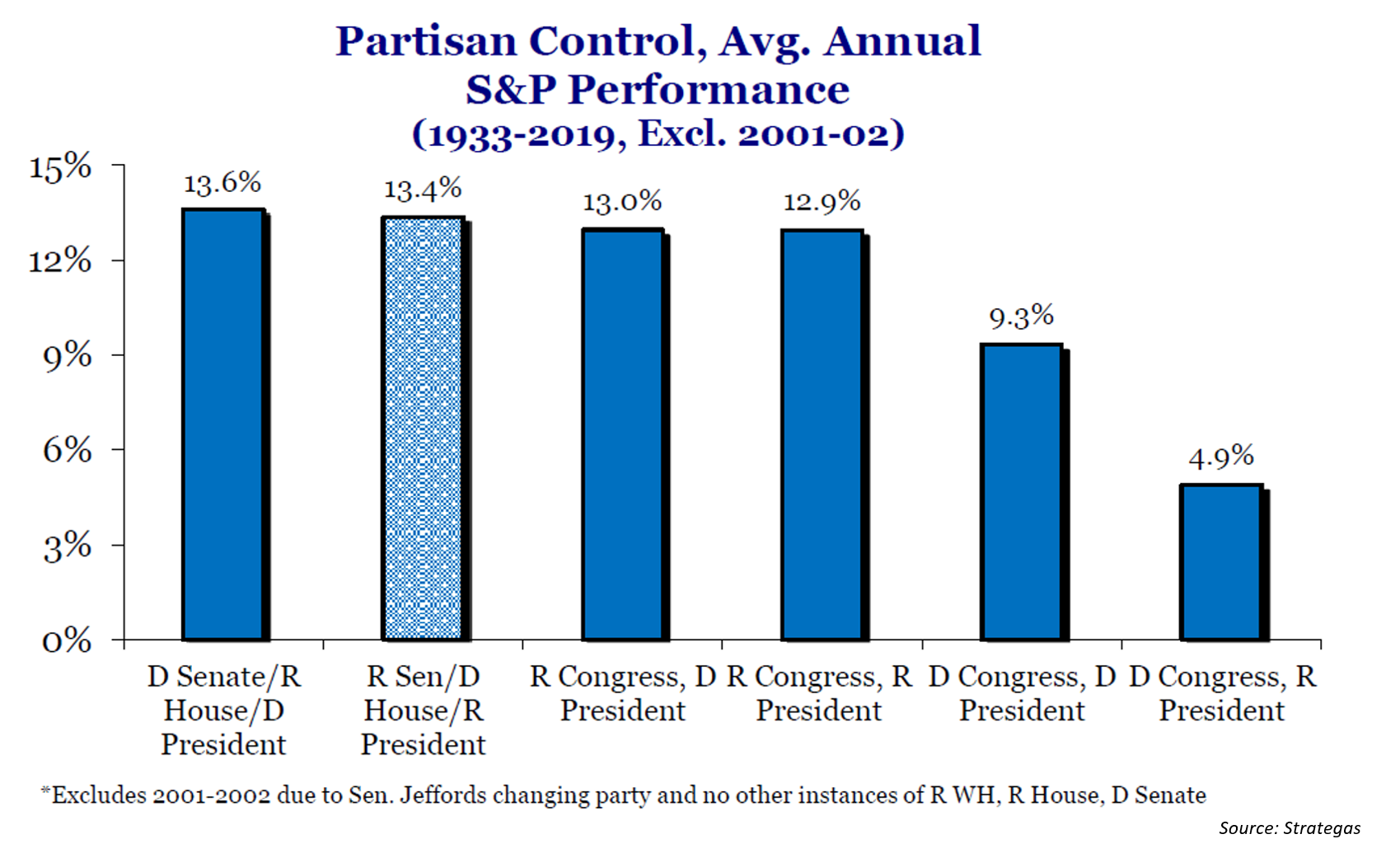

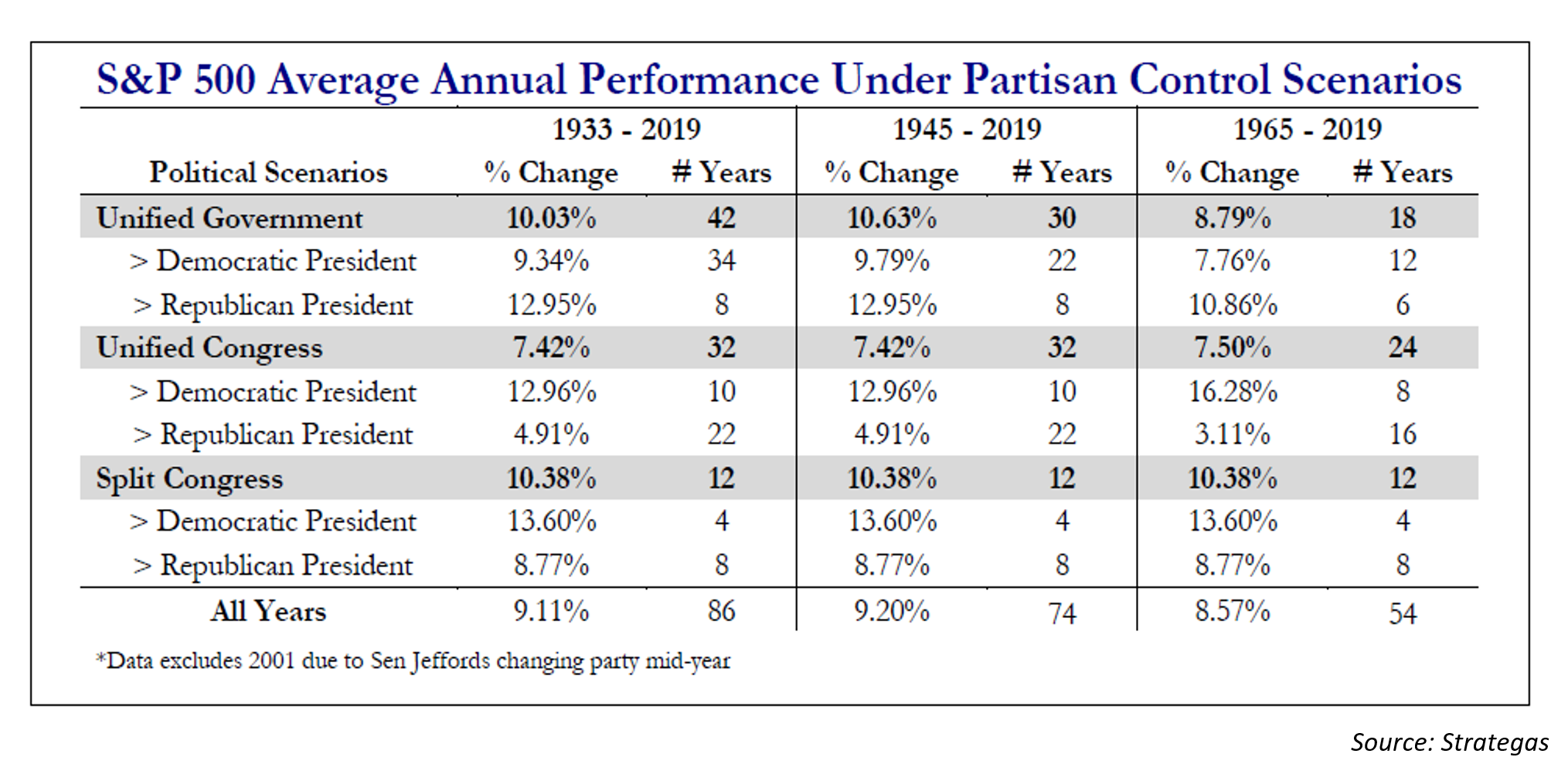

On the forefront of many investors’ minds, is who will be the the winning party, and most importantly, the effects that their administration will have on certain policies and sectors. Furthermore, much of this will be contingent on the Congressional makeup, which will determine the ease of passage of these key platform proposals.

Every presidential election is different, but an election during a pandemic may be a real departure from the norm. Let’s assume economic conditions go back to normal and we put COVID-19 behind us. We would expect Biden’s policy priorities to focus on bolstering the Affordable Care Act, infrastructure, clean energy, and immigration. After reviewing Biden’s policy positions, we are not of the view that Biden is a moderate on policy. In fact, we believe Bernie Sanders forced all of the candidates to the left, outside of Medicare for All. Biden may seek to moderate his positions as the general election takes hold, but that has yet to be seen.

Ultimately, we believe the market will perceive a Republican regime as more business friendly and a Democratic regime as more negative for risk assets, but medium to long-term ramifications of either scenario are less clear cut.

Let’s Get Caught Up on the Election:

Trump was losing in the swing states by 7 percentage points at the writing of our September Election Update. He has cut that deficit down to 3 percentage points since then. The tightening of the race coincides with the number of new COVID-19 cases falling and, as a result, the US economy re-opening.

With less news about COVID, the issues in the election have shifted to the economy, the Supreme Court, and law and order. This has made the race less of a referendum on Trump and more of choice between the two candidates. However, if COVID flares up again in the US, we believe the race will again become about Trump’s handling of the virus and economic expectations will fall – hurting the incumbent.

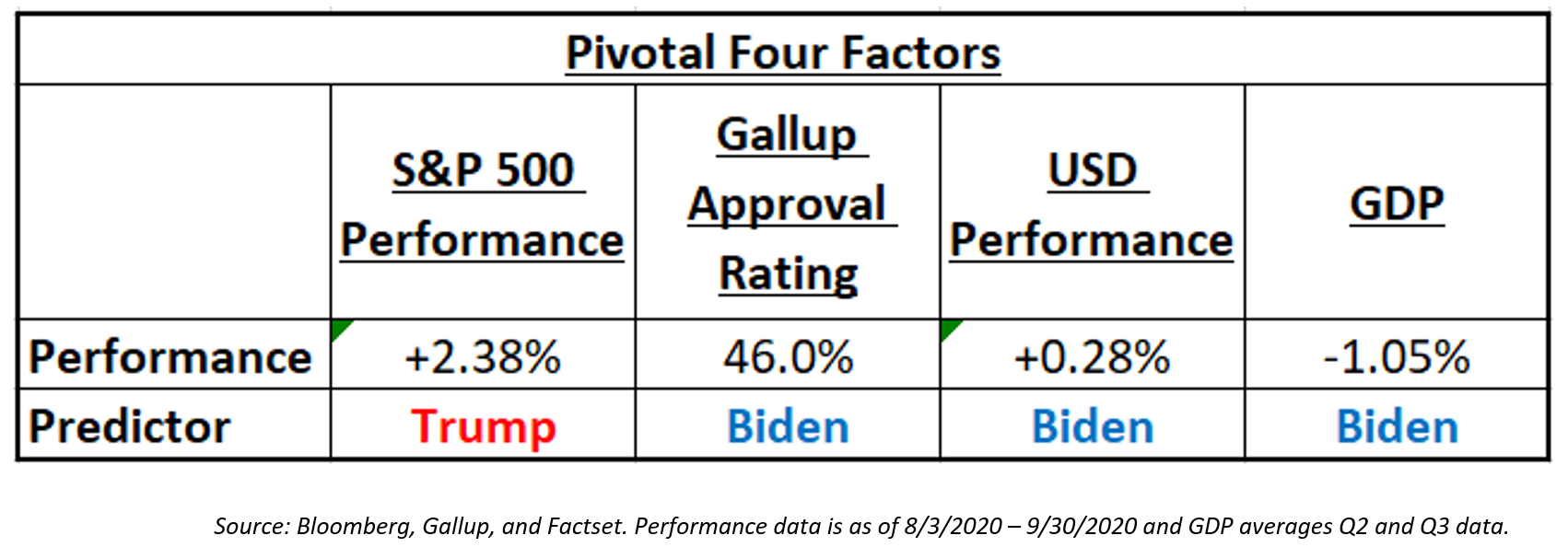

Since 1988, there have been four standout factors that have predicted the popular vote results correctly in every election. Currently, per Strategas, there are four variables suggest that the election is much closer than the polls are reading, but that Trump’s trend has been falling in September with equities selling off and the dollar rising. Here are the pivotal four factors:

1. S&P 500 is higher in the 3-month Period Preceding the Election = Incumbent Win

2. USD Decline in the 3-months Before an Election = Incumbent Win

3. GDP Expansion = Incumbent Win

4. Gallup Presidential Approval Rating > 50% = Incumbent Win

Although the four variables have been predictive in the past, they are by no means perfect and there could be limitations to future results. Estimating the percentage of the vote a candidate receives may send a false signal given that a president can win the Electoral College but lose the popular vote. This year mail-in voting introduces a new level of uncertainty, especially if there is a higher error rate for mail-in ballots relative to machine voting.

Market Outlook on a Biden v. Trump Administration:

Winning the White House is one thing, but if Republicans control the Senate, Biden will have some limits on him in the areas of tax, healthcare, and energy. But if Democrats sweep, the possibilities for what can get done in key policy areas change, most notably on taxes. So let’s dig into some of the key issues facing Americans in the 2020 Election.

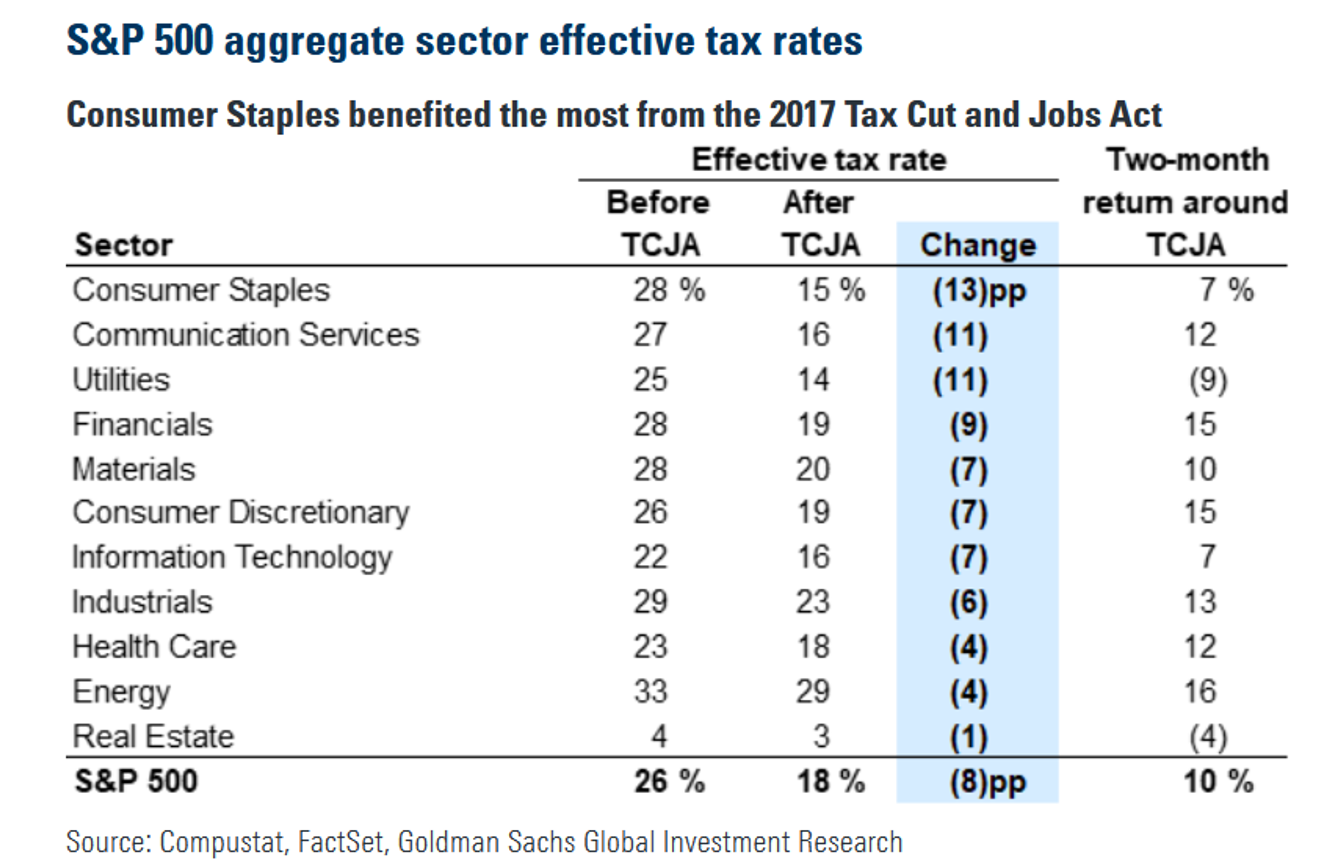

• Taxes: As we expected, Biden’s tax plan fits what we view as the status quo protocol that has been a platform for Democrats for decades. His proposal has four key features: 1) Raise the top corporate tax rate; 2) Raise the top individual income tax rate; 3) Equalize capital gains and dividend tax rates with ordinary income; and 4) Remove step up in basis from the estate tax so heirs pay taxes on the original basis of the asset. Couple this with Biden’s minimum wage proposal ($15/hour), there could be a material impact on economic profits. We believe both of these policies would reduce corporate earnings, as increased taxes would directly reduce EPS, while an increase in minimum wage would compress margins for companies in specific sectors (especially hospitality). If future earnings definitely go down (because of higher taxes or lower margins) then we believe stock prices will go down, at least initially.

• Immigration: We predict Biden would quickly move to roll back many of President Trump’s executive orders and actions on immigration. First, we believe Biden would revoke Trump’s declaration of a national emergency to build the border wall, rescind various travel and asylum bans, and end the “Remain in Mexico” and “metering” border policies that prevent migrants seeking asylum from entering the United States. In our opinion, a Biden administration would also move quickly to reinstate and extend protections for undocumented immigrants who came to the United States as children and who have been protected under the Deferred Action on Childhood Arrivals program. It would grant these so-called “Dreamers” access to federal student loans.

• Infrastructure: From our perspective, the pure play on a Democratic sweep is an infrastructure bill that will likely be considered early in 2021. While President Trump has talked about infrastructure spending, Senate Republicans have been reluctant to do a large infrastructure package. Hence, the Congressional make-up matters the most for infrastructure and we believe a Democratic sweep significantly raises the odds of a large-scale infrastructure package. We would expect this program to boost highway, transit, rail, water, green energy and broadband spending.

• Trade Policy: US-China relations are on a long-term path to decoupling regardless of which party wins the election. The presidential election, however, will determine the speed at which this decoupling will occur. Our expectation is that a Biden victory will slow the speed of decoupling down and therefore benefits companies that generate larger portions of their revenue from China (semis). We also anticipate that a Biden Administration will be less confrontational with Europe which we believe benefits Germany and German autos.

• Tech Regulation: Trump and the Democrats have been tough on tech platform companies but we believe a Democratic win will usher in more regulation of the sector. Google seems most at risk from the Democrats. Facebook seems safest with Republicans.

Obviously the above mentioned factors will be a driving force of how different sectors within the S&P 500 perform. So, let’s take a look at the implications for these sectors:

• Health Care: Democrats are campaigning on lowering drug costs and creating a public option to compete with managed care companies. From our view, both policies are negative for health care stocks. But our second most out of consensus view for this election is that Democrats will not move forward on a public option and instead will increase access to the ACA. Under a Democratic sweep scenario, we believe Democrats would also do well at the state level and could expand Medicaid which benefits Medicaid HMOs and hospitals. We also anticipate a push for more National Institutes of Health spending. Also keep in mind that if the Republicans sweep, we believe the GOP can meaningfully change the ACA. In our opinion, a Democratic win avoids that. Obviously, the game changer here is the passing of Supreme Court Justice Ruth Bader Ginsberg, which is a topic on a whole different level.

• Energy: We believe energy policy will receive less attention on the campaign trail but will be an early priority for both parties post-election. Energy stocks did not fare well under Trump’s deregulation because supply increased. Yet, Democrats are looking to be more strick on the sector through tougher climate rules, limiting pipelines, freezing public land fracking and a moratorium on offshore drilling. Couple these changes with a new Iran deal to increase supply and we believe a Democratic win will likely have a negative impact on fossil fuel companies.

• Renewable Energy: We believe a Democratic sweep will push the US away from fossil fuels by raising the cost of fossil fuel production through regulation and higher taxes while lowering the cost of renewable energy through subsidies for wind, solar, electric vehicles, and biofuels. We expect climate change to be an immediate priority for the Democrats and predict there will be a push for a carbon tax that can be used to pay for infrastructure. Our most out-of-consensus view is that a carbon tax benefits ExxonMobil over frackers. From our view, US climate policy also benefits non-US energy companies over US companies since the non-US companies already face these costs in their home countries.

• Financials: No sector benefitted more from a Trump win in 2016 than financials. Under a Republican sweep we would expect further de-regulation and tax cuts which benefits financials. We believe a Democratic sweep could also overturn new deregulation efforts through the Congressional Review Act, which slows deregulation efforts. From our perspective, the Consumer Financial Protection Bureau will be a main target. We would also anticipate legislation targeting data breaches. Finally, we believe efforts to repeal a portion of the corporate tax cuts are negative for growth and by extension yields.

• Technology: Policy considerations for the tech sector have been relatively non-existent until recent years, but anti-trust, privacy, and national security concerns have moved the sector near the top of the policy agenda in Washington, DC. Overall, there is near universal agreement that new legislative and regulatory action should occur, but there is almost no agreement on how to achieve these goals. While DC is increasingly part of the conversation for technology, we continue to believe the secular tailwinds for the sector are more important for investors. Additionally, should DC act, we believe it could accumulate to the benefit of the largest players –creating a moat and creating “too small to comply” companies.

• Defense: Heightened geopolitical pressure will keep a bid for defense spending in place regardless of the election. But with the deficit likely to exceed $3 trillion this year, Republicans are more likely to keep spending higher. The debt ceiling needs to be raised on July 31, 2021 and if the Democrats sweep, we could see some pressure on defense spending.

• Industrials: Industrials are a very diverse sector, with significant election consequences including the China relationship, infrastructure spending, defense spending, inflation fears, taxes, environmental regulation, etc. Each impacting industries within the industrials sector differently. Broadly, the sector is aided by accelerating inflation in a material way, so election outcomes that engender more fiscal stimulus (Dem sweep) should be very helpful. Under a Trump victory we believe there is an increased likelihood of disruption of the economic relationship with China, but less risk of higher tax rates, and some chance of modest infrastructure spend, no environmental regs, but decelerating defense spend. If Biden wins, we believe there is less risk of China economic disruption, and increased likelihood of meaningful infrastructure spending, fiscal support payments to consumers/state governments, but a likelihood of higher corporate, personal taxes, increased environmental regulations, steeper deceleration in defense spending. Ultimately, it comes down to whether or not the economy/inflation is accelerating or decelerating.

So How Do you Insulate a Portfolio:

Given so much uncertainty surrounding this year’s election and its effects on the economy, how does an investor navigate the current and ever-changing environment? We believe it’s actually very simple – stay the course. Continue to own high-quality stocks that have the potential to grow at above market clips. In fact, studies show that there is a constant factor that has driven historical outperformance during random bouts of volatility – those typically seen during an election cycle. We believe the secret sauce is simple – owning high-quality companies.

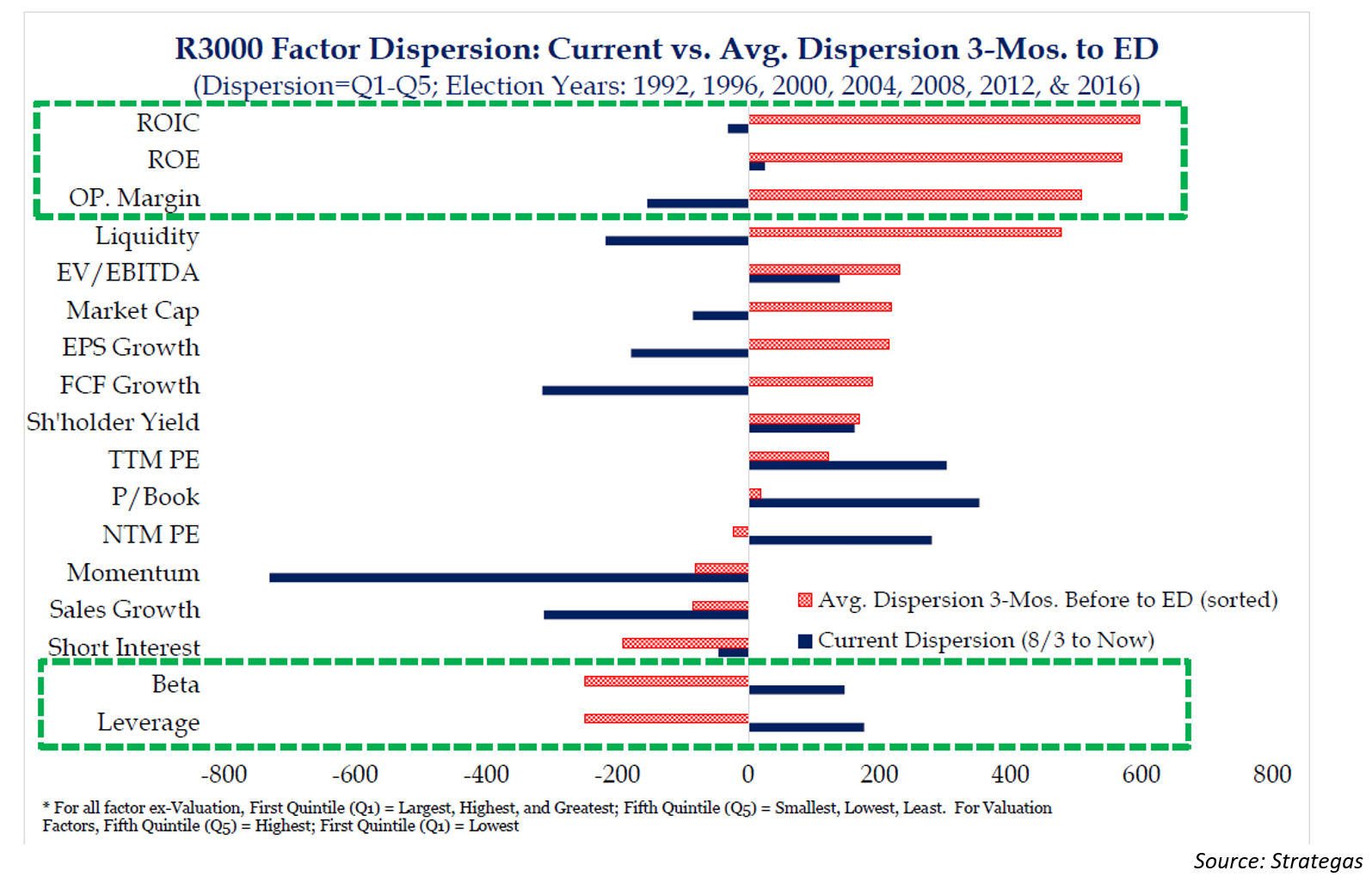

Looking back on each election cycle since 1992, you can see that quality factors (High ROE/ROIC, High Margin, etc.) have been favored by investors in the run up to Election Day. With less than a month and a half to go, we can already see the emergence of similarities between today’s tape and the historical pre-election factor performance profile; High Quality has started to accelerate while High Beta and High Leverage have begun to slip relative to their factor quintile counterparts.

In a nutshell, do not try to time and guess what and how the market will reward certain sectors and industries given an election outcome. Continue a regimented path and let the market reward you for your long-term time horizon.

Conclusion:

We do not see either immediate election outcome as a bearish gamechanger for the market, regardless of who controls Congress. There may be a knee-jerk reaction from the market that will likely be based on perceptions of a Republican regime as more business friendly and a Democratic regime as more negative for risk assets, but medium to long-term ramifications of either scenario are less clear cut.

In our opinion, if there is a “Blue Wave”, i.e., a democratic sweep, there is a higher probability of short-term volatility which might impact market returns for the remainder of 2020. But the reality is that even when one party is in control of Congress and the Presidency, meaningful change is hard to effect. Case in point, it took nearly two years for Democrats to pass the Affordable Care Act, and they had strong majorities in Congress and the Presidency. Similarly, Republicans failed to repeal Obamacare despite controlling Congress and the Presidency, and it took two full years to pass the Tax Cuts and Jobs Act.

So, beyond policy, we think the bigger medium-term drivers of market performance will be:

1. Fed Policy (do we get more QE?), and

2. Fiscal Stimulus (Does the economy get more stimulus before year-end or early 2021?).

Policy decisions from the government will impact the markets over the years, but we believe investors should cross those bridges as they come to them. Bottom line, we view neither the Trump nor Biden as bearish gamechanger for anyone with a time horizon stretching into early 2021 and beyond. But, there is one thing that is very clear to us: volatility is likely to re-emerge in the months leading up to the election, especially given that there is uncertainty around the election (especially a contested one) and that the market is currently trading close to all-time highs.

Disclosures:

Securities offered through Triad Advisors, LLC. Member FINRA/SIPC.

Clearing, custody or other brokerage services may be provided by Fidelity Brokerage Services LLC or National Financial Services LLC. Member NYSE, SIPC.

Investment advisory services & insurance services offered through Sugarloaf Wealth Management LLC, a Registered Investment Advisor not affiliated with Triad Advisors LLC or Fidelity Investments, Inc.

Please do not place orders for investment transactions on the email system, they cannot be honored.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment and tax professional before implementing any investment strategy.