Investing in the stock market can seem perilous at times. Imagine a scenario where you are journeying through the wilderness making your way to your destination. On your path there may be short-term interruptions or obstacles that may upset you. How one responds to the situation at hand has an impact on your travels: Will you stay put and journey no farther upon the encounter of adversity? Will you give up and retreat to where you came from? Or will you remember your goals and your purpose behind what you are doing, press on, and take heed to wise counsel? Investing for the long term is much like this. The investor who makes an informed plan and endures short term adversity with the calculated expectation of their needs and goals being met in the long term is rewarded.

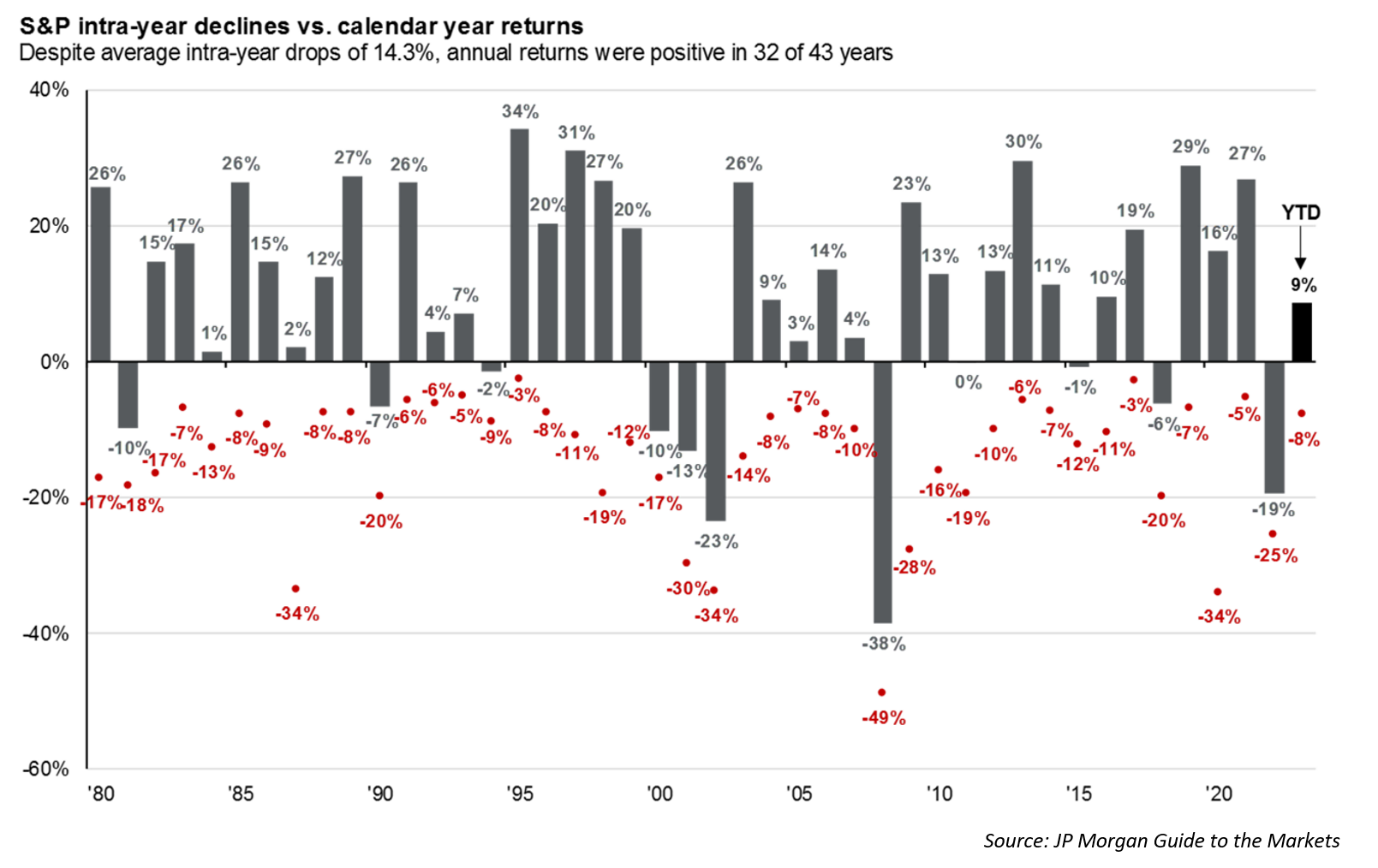

In this brief article, we aim to show you how different sorts of investors fare and the benefits of waiting with patient endurance. First, look at the below illustration for the historical intra-year volatility of stocks.

As you can see in the above illustration, stocks in most years may have somewhat significant low points during the year, but stocks end positive for the calendar year more often than not. The average intra-year drop is 14.3% and annual returns were positive in 32 of 43 years. What does this tell us? Historically, stocks are volatile and reactionary, but are positive most of the time. To wit, volatility in stocks is a normal and expected part of investing, and patient investors who don’t sell at the low points, given enough time, prove successful and reap rewards.

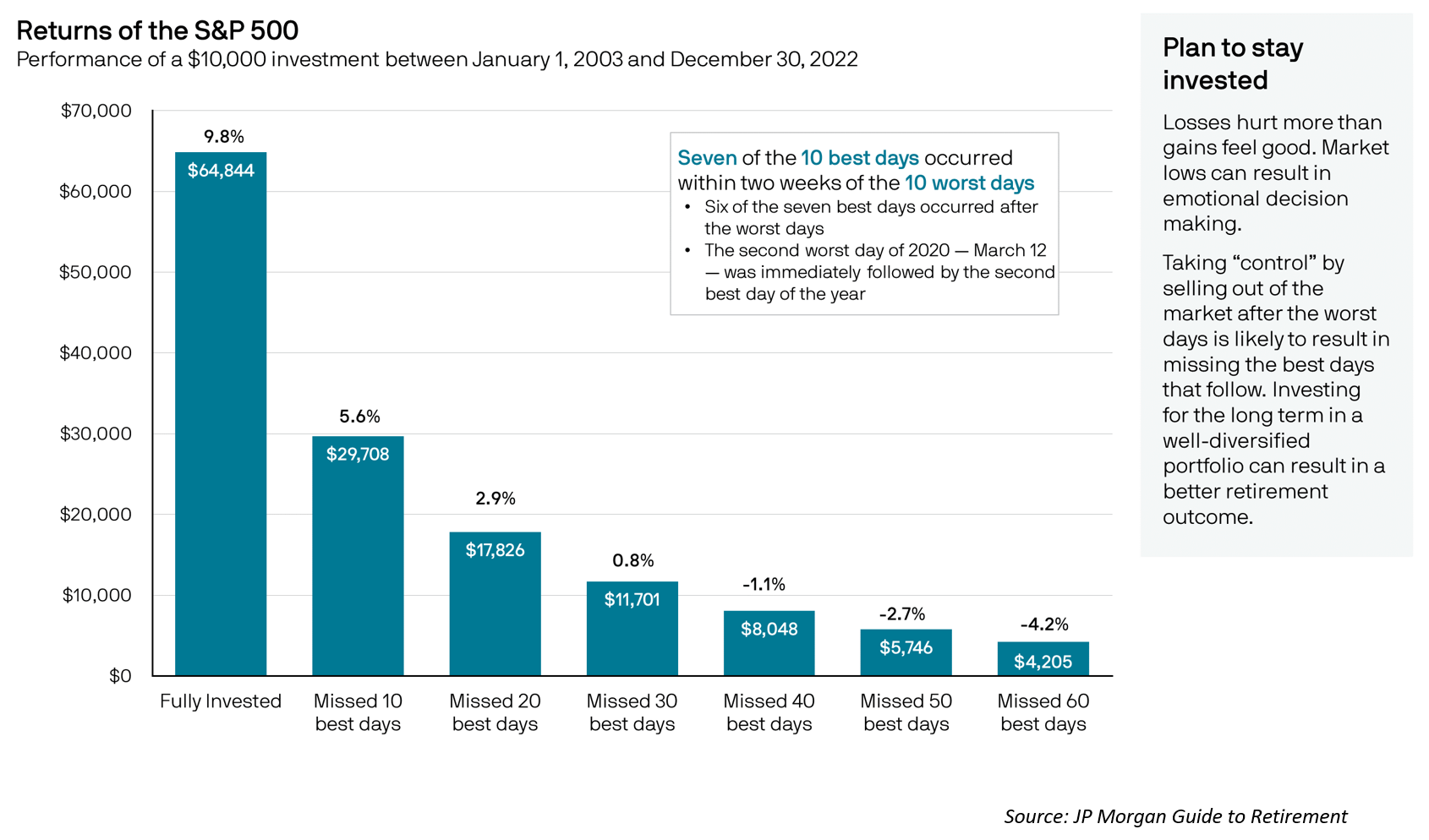

Here is a chart illustrating how missing some of the best days of returns can significantly stunt the growth of a portfolio:

Suffice it to say that investors who do not react to negative news and events do better than ones who do, even a little bit. The problem with exiting the market is one of timing. Not only does the investor have to sell at the right time, but they must also buy back in at the right time to capture the gains. Timing the markets is nearly impossible, so the best strategy for most investors is to stay invested through the ups and downs.

It is important to design a portfolio that corresponds to an investor’s time horizon, goals, and personal risk tolerance that will help them meet their needs without taking unnecessary risk and staying invested in the long haul. At Sugarloaf, we use financial planning to guide our investment decision making to help you achieve your goals.

– Emory Linder