2021 Market Themes

“Everyone has a plan until they get punched in the mouth”, a quote made famous by a man whose antics in the ring were just as infamous as they were outside of it, Mike Tyson. Last year, forecasting experts felt like they were uppercut by the boxer himself, as their forecasts were most likely TKO-d in the early rounds, i.e., February, due to an unexpected worldwide pandemic. Given the current economic backdrop, we aren’t going to try to call a Buster Douglas type of upset over these consensus themes, as his victory odds versus Tyson were priced at 42:1, we’ll just cover some of the recurring consensus calls that we keep seeing in the marketplace from a wide array of analysts.

You Have to Know Where You’ve Been to Know Where You’re Going

The profile of the global equity market through the current recession has, so far, been more extreme than most cycles. The market fell into a recession much faster than average (the fastest since 1929), while the rebound has also been much swifter than any correction in history. From our perspective, the speed of the bear market was understandable given the almost complete stoppage of economic activity experienced in the early part of the year, while the sharp pace of the recovery owes much to the unusual nature of the recession and the scale of policy support.

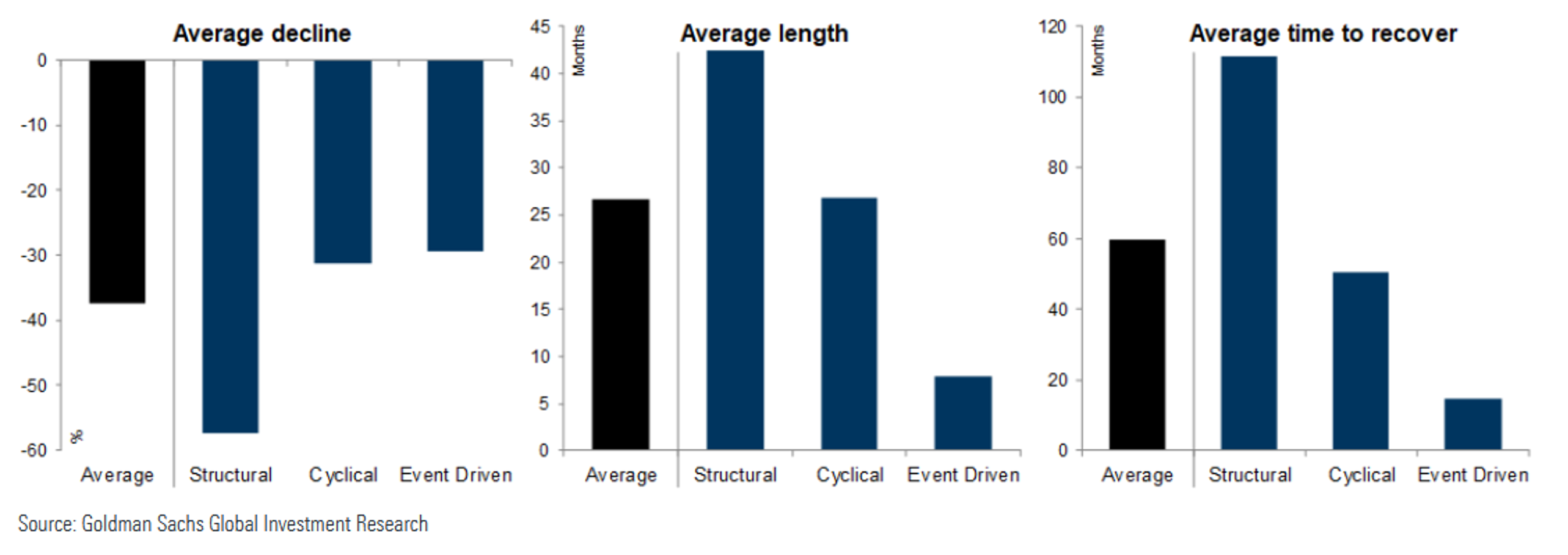

If you look at the underlying reasons that a bear markets occurs, you can classify them as follows:

• Cyclical bear markets – typically driven by rising inflation and interest rates.

• Structural bear markets – preceding major imbalances or bubbles, typically associated with banking and/or real estate

• Event-driven bear markets – typically the result of exogenous shocks to the economic cycle and corporate profitability.

Historically, cyclical and event-driven bear markets tend to be similar in depth, but the event-driven ones tend to happen more quickly and revert to previous levels in a shorter period. In that sense, the profile of this bear market has not been quite unusual.

Likewise, the equity rebound was unusually impressive given the scale of the economic shock that unprecedented lockdowns put on the economy. This fallout prompted monetary responses that exceeded those employed in the aftermath of the financial crisis, and was supplemented by significant discretionary fiscal easing. The combination of efforts re-established a ‘central bank put’ and introduced a ‘fiscal/government put’ philosophy, moderating concerns about longer-term structural damage to economic and productive capacity.

Why is looking at the market in this lens important? Well, this recovery is very much different than anything we have ever seen before, due to the aforementioned reasons. But, bottom-line, we believe investors can’t always look to history as a guide on how to navigate current market conditions. The market is continuing to evolve, and for investors to stay relevant, we believe they need to evolve with it.

Where are We Going – The Great Normalization

We believe an easy monetary policy, a weak dollar, a rebound in the old economy accompanied by a synchronized global upswing is the perfect backdrop for the S&P 500 in 2021. Notwithstanding the second and third COVID-19 waves permeating the world, there is a profound feeling that the global economy is resynchronizing with the household, corporate and government balance sheets expanding simultaneously alongside aggressive monetary policy.

Overall, we believe that a “great normalization” has begun here over the past few months. Here are some of the main bullet points on where we stand going into 2021:

- It may take years, but the great reversion to a normalized economy has likely begun.

- From our view, analysts are expecting substantial earnings growth as economies re-open globally, which will be aided by substantial excess savings during the shutdowns, and historically low inventory levels.

- Forward P/Es are high, in the 96th percentile since 1954, and generally we predict forward returns are flattish for the next several years, although the time periods the market has traded at this valuation level is small.

- We believe this makes 2021 – 2023 likely a period where there is a high probability that EPS increases materially, but P/E may contract substantially.

- On a relative basis, we have seen analysts expect stronger returns for smaller caps and cyclical stocks, as these two areas tend to outperform at the beginning of economic cycles.

What are the main risks to these expectations?

- Virus Mutation Obviates Success of Vaccines

- Market Over-Reacts to Near-term Inflation

- Fear of Fed Capping the 10-YR Rate Driving the Yield Curve Flat

- Consumers Don’t Spend Pent Up Savings During the COVID-19 Shutdowns

- Increased Regulations and Taxes

More Stocks Than Bonds

From an equity market perspective, the backdrop of historically low bond yields should be supportive for equity markets, particularly if the economy is accompanied by stronger growth. Bond yields are at historic lows and the proportion of global bonds offering a negative yield has increased to roughly one-quarter.

Following a collapse in interest rates, the TINA (there is no alternative) argument attracted many income-oriented investors into stocks, i.e., out of bonds, and we believe this argument still prevails, where the S&P 500 dividend yield is close to 2x the 10-year yield – a bullish signal for equities over bonds. Right now, 70% of S&P 500 companies trade at a higher yield than the 10-year, a level never seen before, also a historically important indicators for stocks over bonds.

As investors know, the trend in interest rates has been trending down since the early 1980’s and, historically, holding bonds has proven to provide sufficient returns and stability in times of volatility. A crucial piece of the total return for fixed income, as interest rates get lower and lower, investors must carefully understand how returns will be generated moving forward.

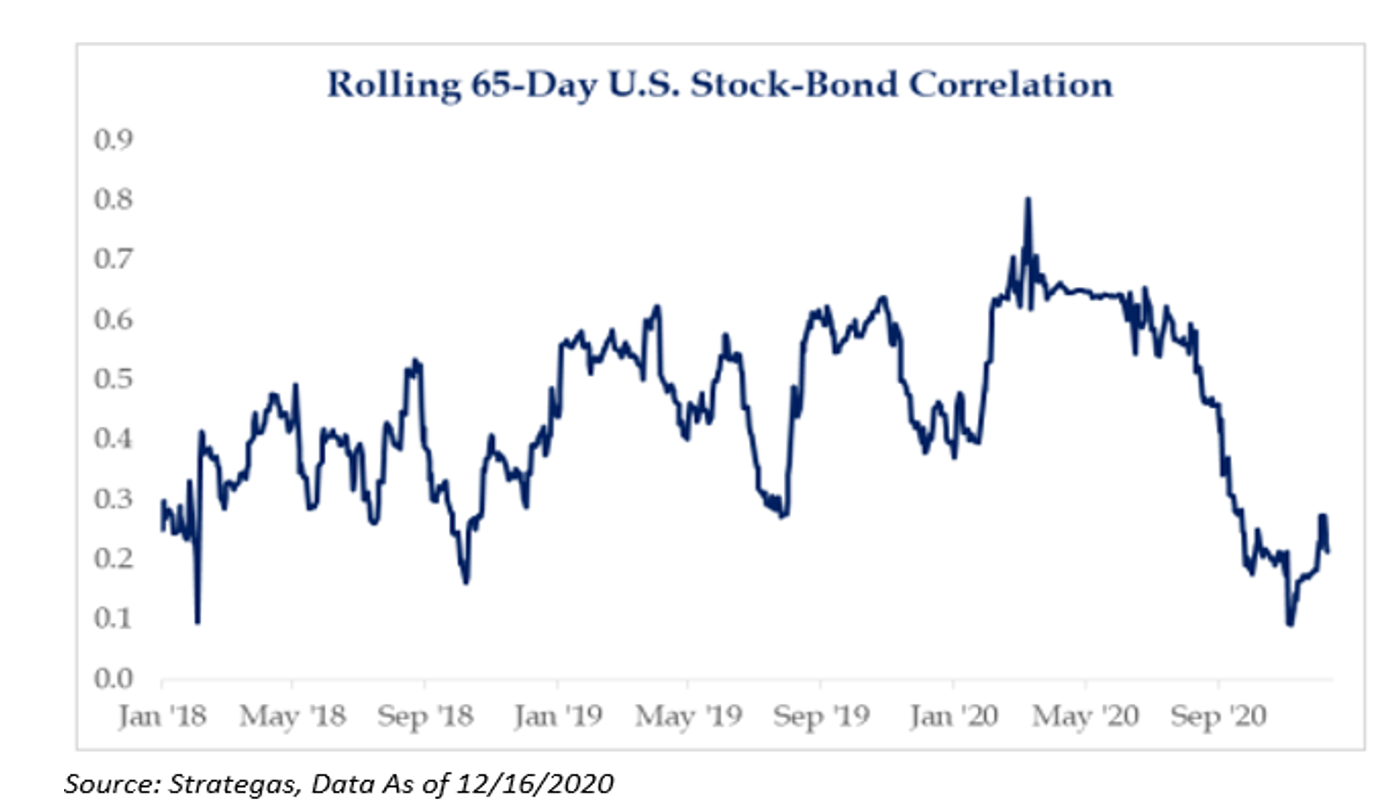

Without historic negative correlation, the benefit that bonds have had with equities during bouts of volatility is no where to be found. Investors have already started to see this correlation breakdown.

GDP in an Uncertain Environment

From a market perspective, the crucial issue now that the election is out of the way is what will happen to growth, and this is now increasingly dependent on a COVID-19 vaccine. From a GDP perspective, the strong rebound that analysts expect to see next year could mean that the global economy gets back to the GDP levels of end-2019 by around mid-2021.

From what we’ve seen, analysts expect GDP to re-accelerate sharply around February and average 4.5% in 2021, which would be the best growth since 1999. The initial surge is predicted to be driven by fiscal stimulus, which at the minimum will extend supplemental unemployment benefits which expired this fall and pay them retroactively. Consensus expects the law to pass in late January, with funds hitting the economy in February and creating solid growth momentum at the start of Q2 2021.

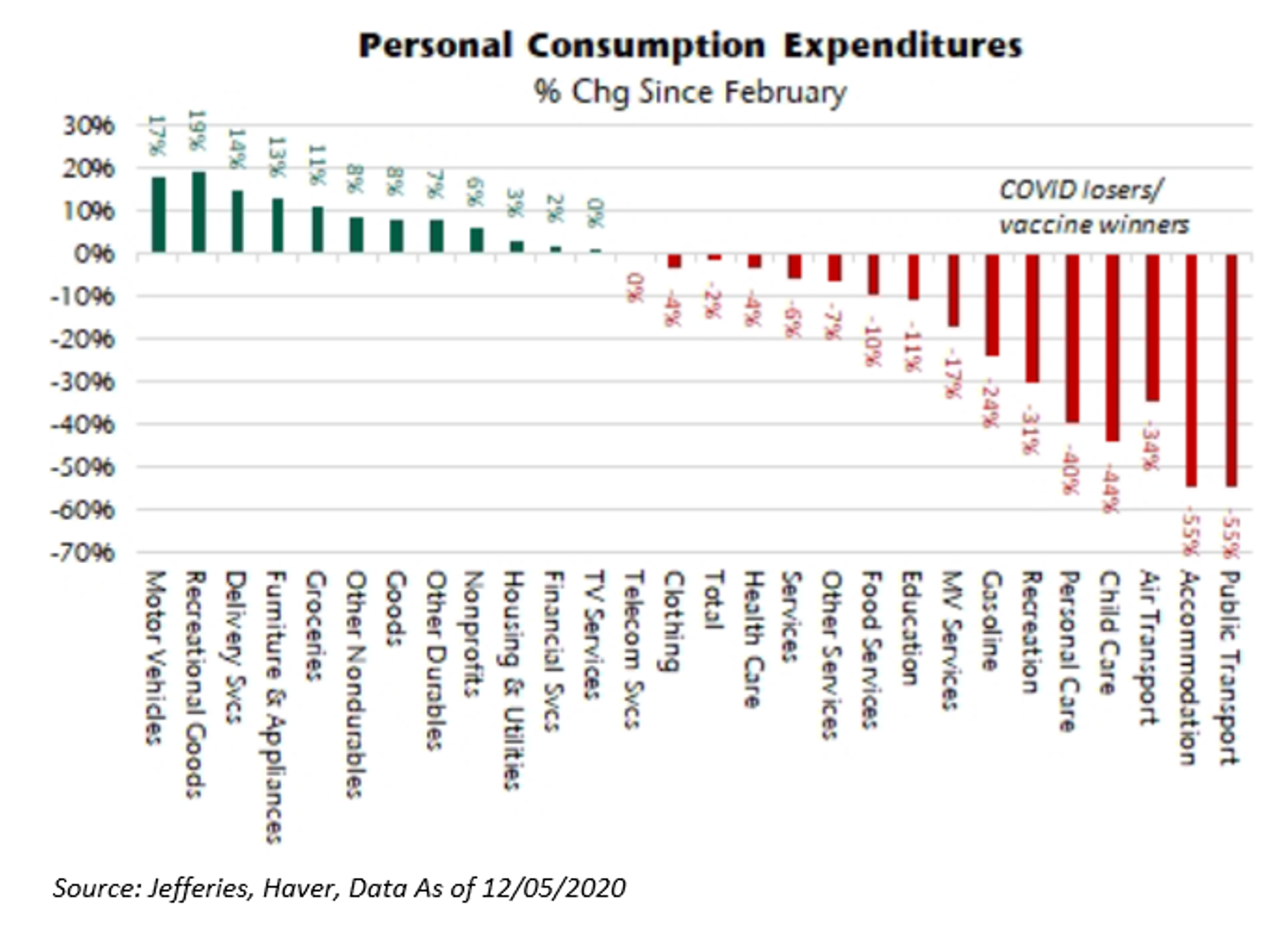

By the end of Q2 2021, analysts expect the COVID-19 vaccine to be widely available and administered to roughly half of the US population. This is predicted to set the stage for the second leg of reopening, this time driven by a return of high-contact activity. As shown in the chart, spending is still well below pre-COVID levels, and this is where we see the strongest growth potential.

The good news is that we believe post-vaccine growth will not be dependent on employment or fiscal stimulus as it will be largely financed out of excess savings and driven by high-income households. The top 25% of US households have suffered virtually no job losses, yet their spending is still down nearly 10%, with the shortfall likely concentrated in high-contact service spending. In contrast, low-income household spending is back to pre-pandemic levels, even though employment is down 20% in this cohort (courtesy of fiscal stimulus). As high-income households increase their spending on travel, food services and recreation, this will increase demand for low-income jobs, ultimately supporting spending across all income levels.

Analysts expect most of 2021 consumption growth to come from services, with goods spending likely to level off. This might limit the upside for retailers, but not for producers of consumer goods. That’s because retail inventories are still extremely low, and we expect the restocking cycle to continue through 1H 2021, driving much of the 2021 GDP growth.

Faster-than-Expected Earnings Recovery

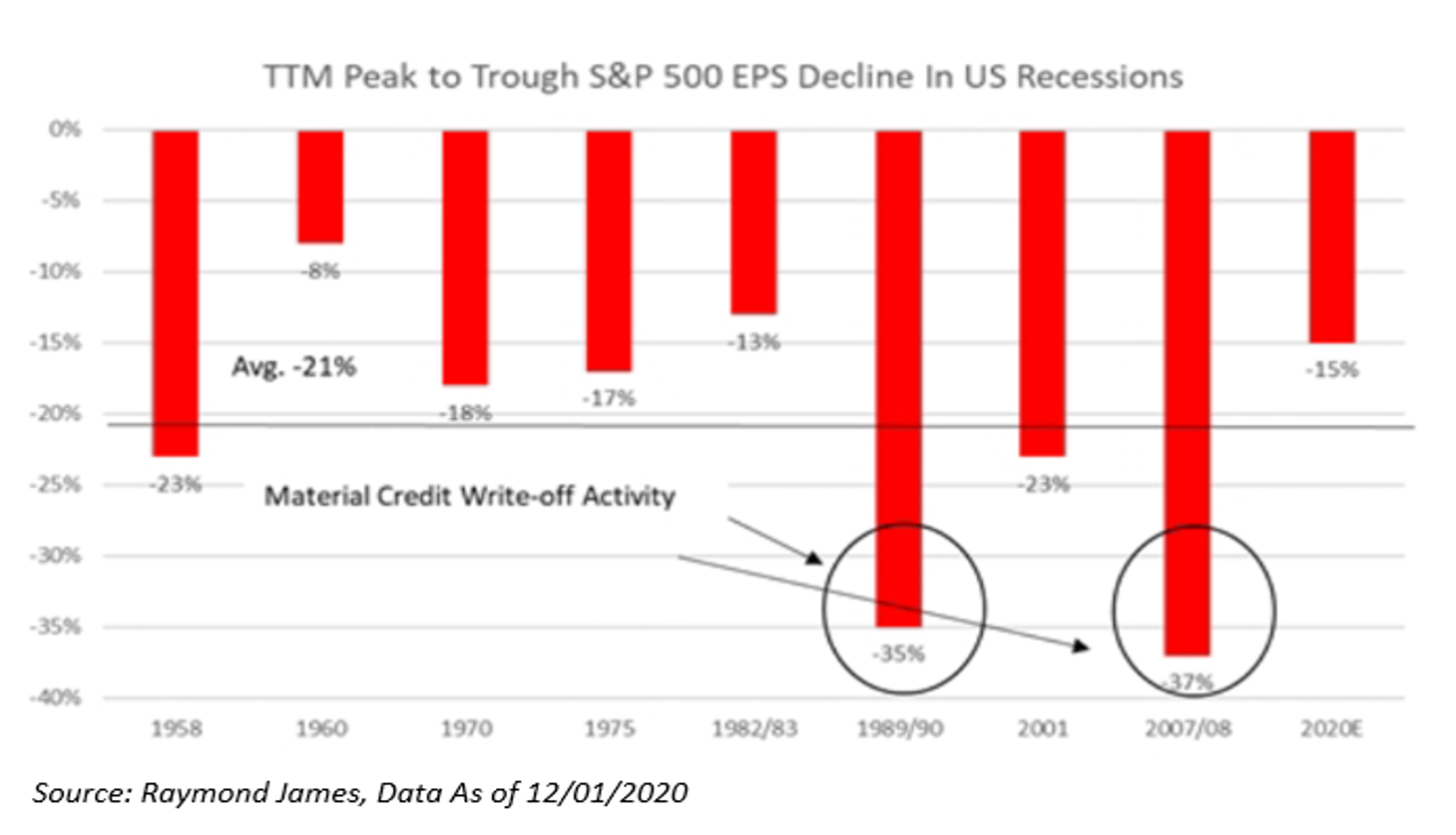

Given the expectation for the fastest GDP growth since 1999, we believe investors should be asking the question, what does that mean for earnings going forward? We know that this recovery is very unusual, unlike any other, given that it takes, on average, 3 – 4 years to have a full recovery in earnings from its previous peak. Thanks to record fiscal/monetary stimulus, S&P 500 EPS decline this year will likely only be ~15%, the mildest peak-trough annual recessionary EPS decline in the S&P 500 since WWII.

So how does the EPS recovery look? Right now, analyst consensus EPS estimates are for 41% EPS growth in 2021-2022 combined, which is a bit above the post-WWII average of 30% EPS growth in first 2 years of an economic recovery. But with all potential dry powder sitting in consumer bank accounts, we think we have to admit, things could be very different this time. And this could be the full rational to why 2021 earnings could fully recover from its previous 2019 peak, creating a much faster-than-anticipated earnings recovery than what history has previously seen.

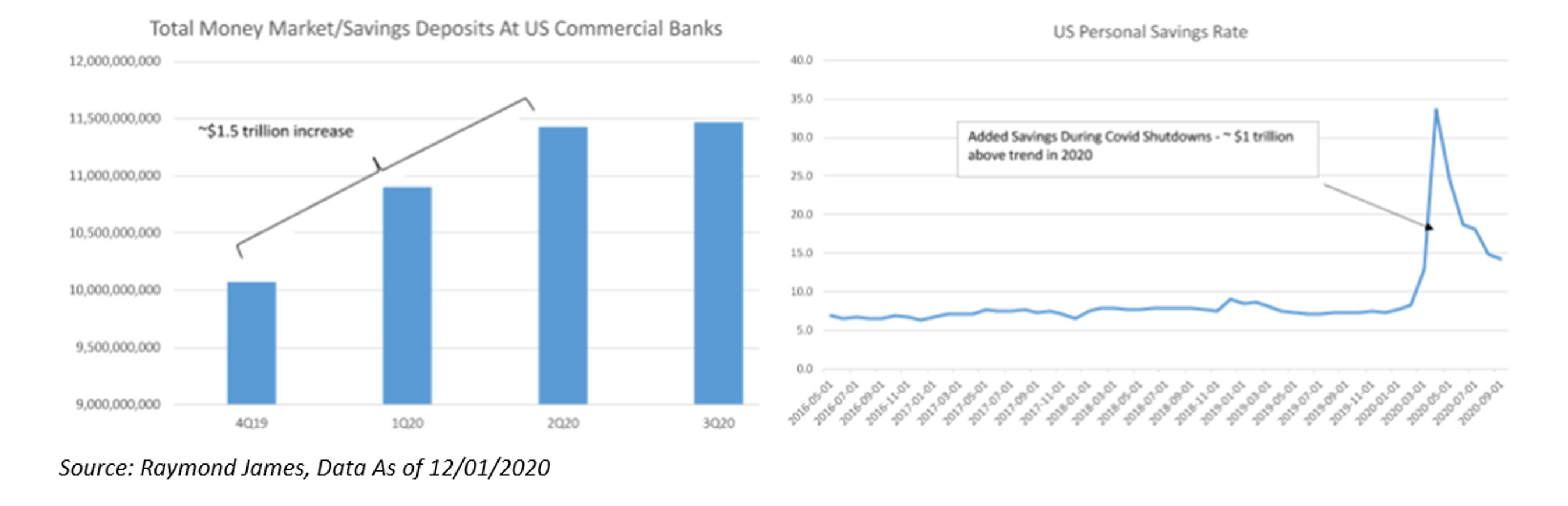

In the U.S., the re-opened economy may be met with a “wall of cash” from consumers and businesses who both became understandably more conservative in their spending habits during the shutdown. If you look at the change in money markets/savings accounts at commercial banks (left) and the personal savings rate (right), there appears to be an excess $1.0T – $1.5T of liquid cash-like instruments in the system right now, relative to pre-shutdowns. This accounts for ~5% – 10% of annual consumer spending in the U.S. How quickly this “wall of cash” gets spent, if at all, will influence much of the economic recovery story in 2021.

Cyclical Over Defensives

Given this “Wall of Cash” and pent-up demand from consumers in 2021, we see analysts expecting cyclical stocks to substantially benefit from a re-opening trade that is very much dependent to consumer spending and a cycle of replenishing inventory.

As we know, the last few bear markets were caused by credit and financial excess that spilled over into the rest of the real economy. This recession was not caused by problems within the economy, but by a virus imported from without. The last few rebounds were about the gradual resumption of economic activity. This recovery has been much more sudden, and financial markets have quickly priced-in the effects of reopening.

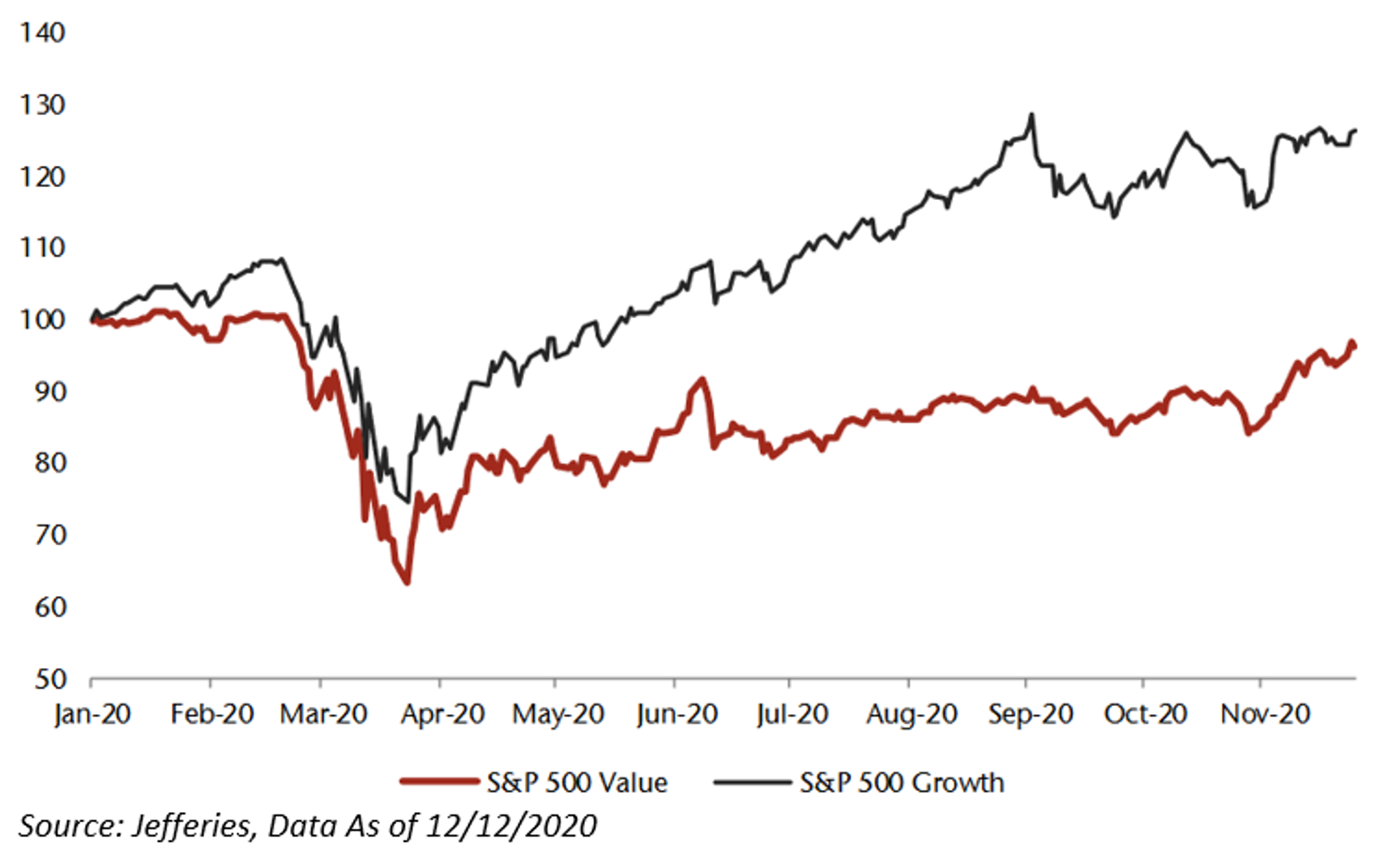

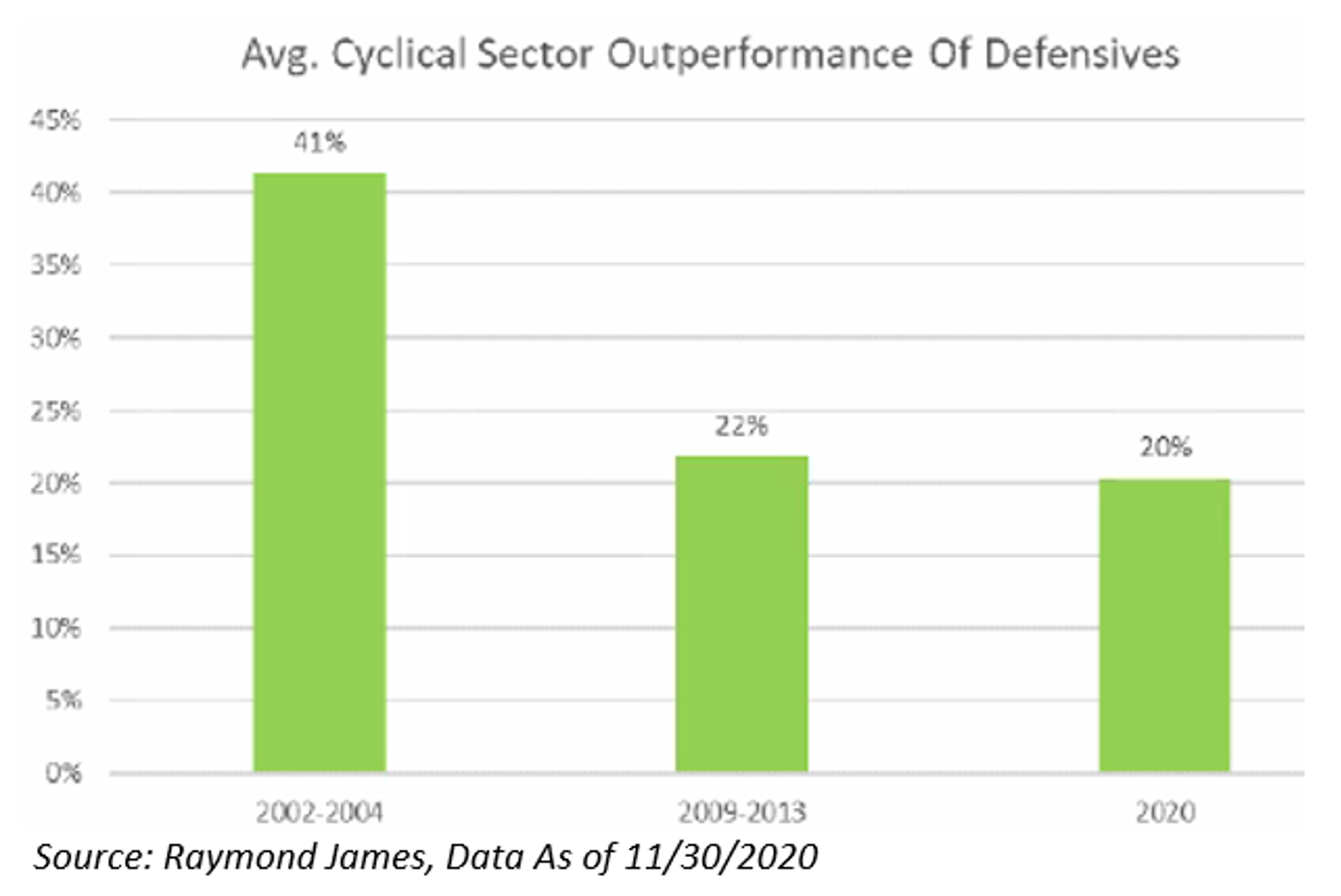

Historically, cyclical sectors – especially cyclical value stocks – lead the rally after a recession. Recently, this trade has been happening again – just look at the rotation trade that occurred November.

Moving forward, especially for cyclicals to outperform, in our opinion, the economic and market outlook is largely hinged on the prospects for controlling the virus, and therefore the timeline for restoring activity in high-contact service-providing industries. Therefore, through a public vaccination campaign—and the help of friendly monetary and fiscal policy—we believe it should be possible to recover a large portion of lost output over the next year. If these things come to fruition, then we think investors should expect a broader and deeper global economic expansion in 2021, which should favor risky assets in general, but the most growth-sensitive assets in particular. Couple this with that fact that defensive stocks have historically seen capital outflows as the economy rebounds, also favors cyclicals.

If all the aforementioned items occur, analysts believe that there remains a long runway for cyclicals to outperform. On average, over the last two recessions, cyclical stocks, from peak to trough, outperformed defensives by 30%, on average. As of the end of November, the outperformance has only totaled ~20%.

Small Over Large

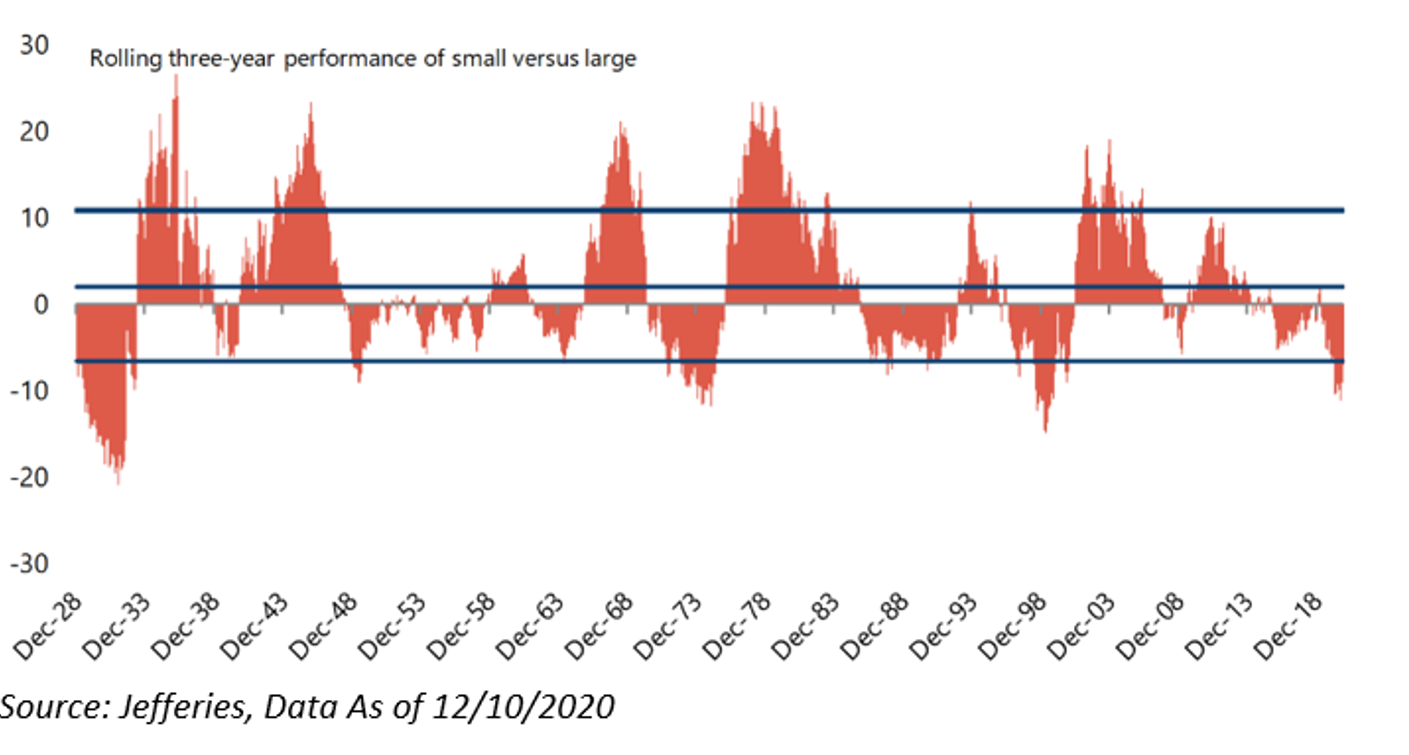

Much like the cyclicals over defensives and value over growth rotational trade that investors have been expecting for quite some time – we believe investors have also been waiting on a prolonged comeback of smaller capitalization stocks versus large cap stocks.

We believe the Russell 2000 Index has substantially underperformed the S&P 500 over the last three years, as investors flocked to safety. Even after its recent rally off the bottom versus large, the performance spread between the two continues to be at record levels, as the rolling 3-year performance remains one-standard deviation away from historical averages.

So, what will finally spark the rotation of small outperforming large? Well, the COVID-19 vaccine appears to be the event that has initiated this rotational trade, as small caps have never been more cyclically exposed relative to large caps than ever before. Thus, if cyclical stocks outperform, we believe small outperformance should ensue. Secondly, small caps have historically outperformed large when the dollar weakens and when the yield curve steepens, both of which, have occurred over the last two months.

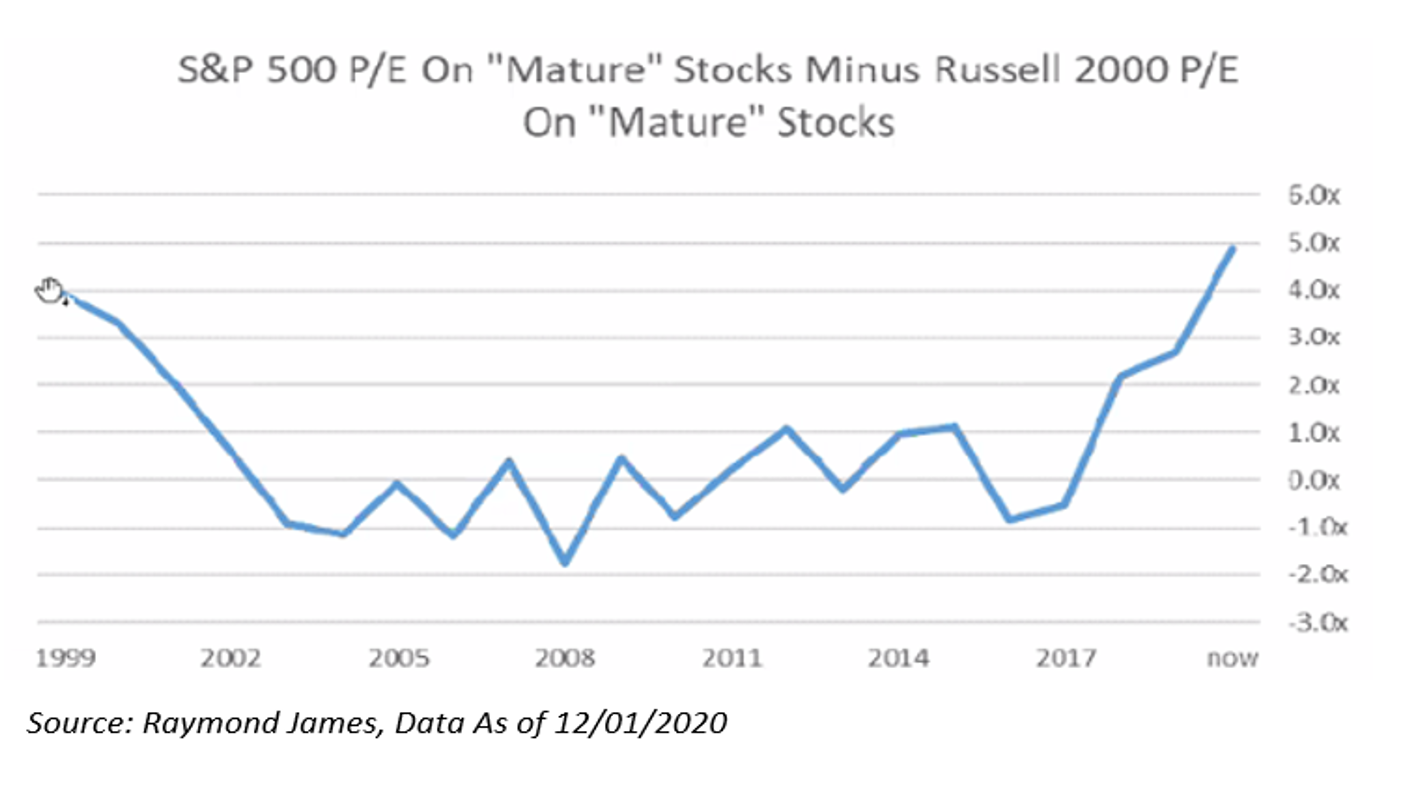

Finally, the valuation trade is very apparent, as we think small caps look very cheap relative to large cap stocks. The valuations spread is now wider than at any point in the last 20 years and is surpassing even the late 1990’s tech bubble era.

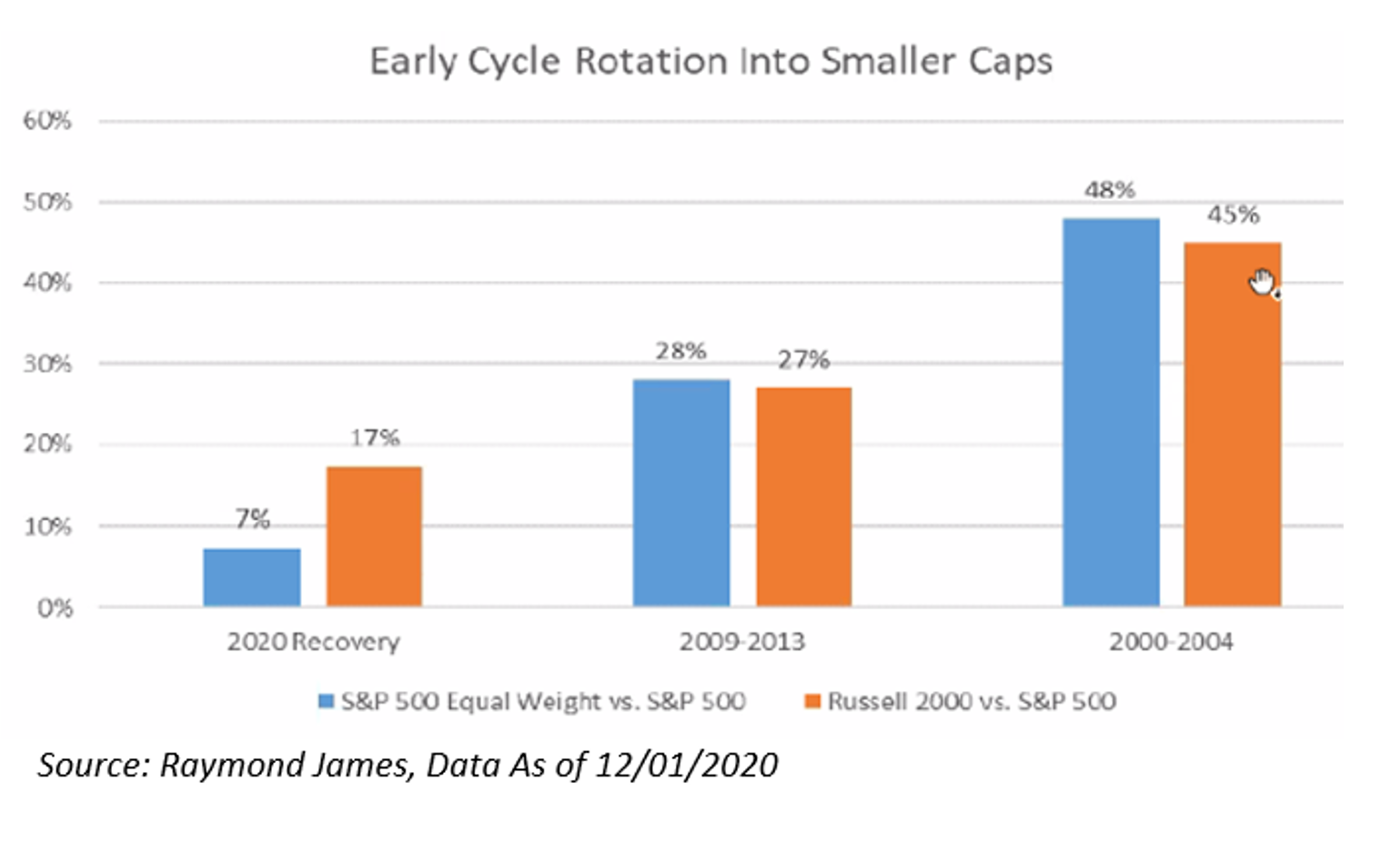

Much like cyclicals over defensives, analysts believe that this rotation into small caps can continue, as each of the past two “early cycle” recoveries, small caps have outperformed both the equal-weighted & market-cap weighted S&P

No Matter the Year, Here Are the Things That Investors Always Need to Remember

As we have already stated, consensus expectations do not always come to fruition – so investors always need to be prepared for what ever is thrown their direction – whether it’s a worldwide pandemic or some type of utopian society where everyone actually gets along. No matter what, investors need to continue to prepare for any market environment, up or down. After this wild year, here are some words of wisdom from the investor behavior standpoint:

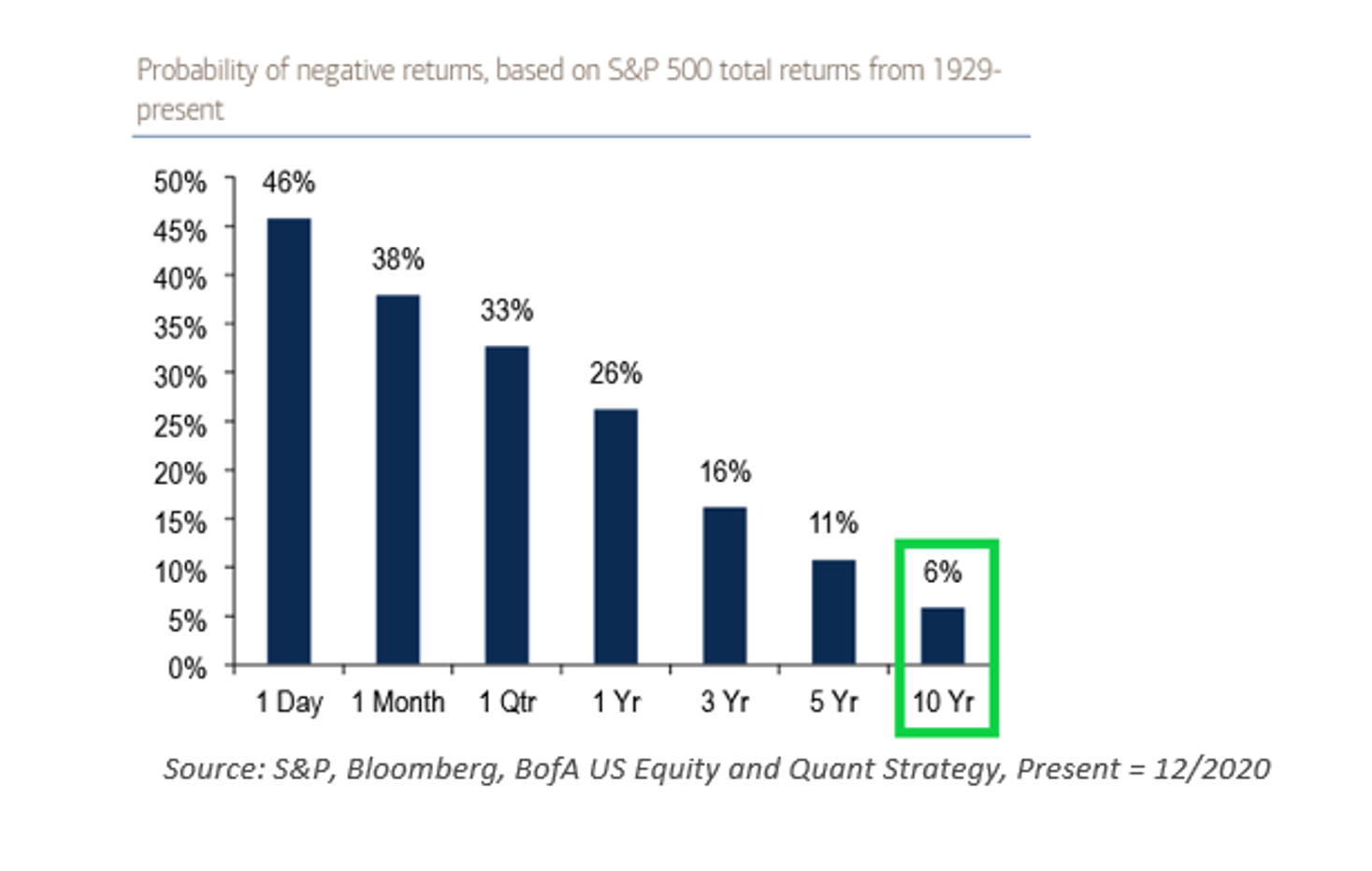

Rule 1: Extend Your Time-Horizon – Historically, lengthening one’s time horizon is a recipe for loss avoidance as the 10YR S&P 500 returns have been negative just 6% of the time. Other asset classes do not sport such characteristics, for example, the same 10YR loss rate for commodities is 30%.

Remember, it’s your time in the market, not timing the market.

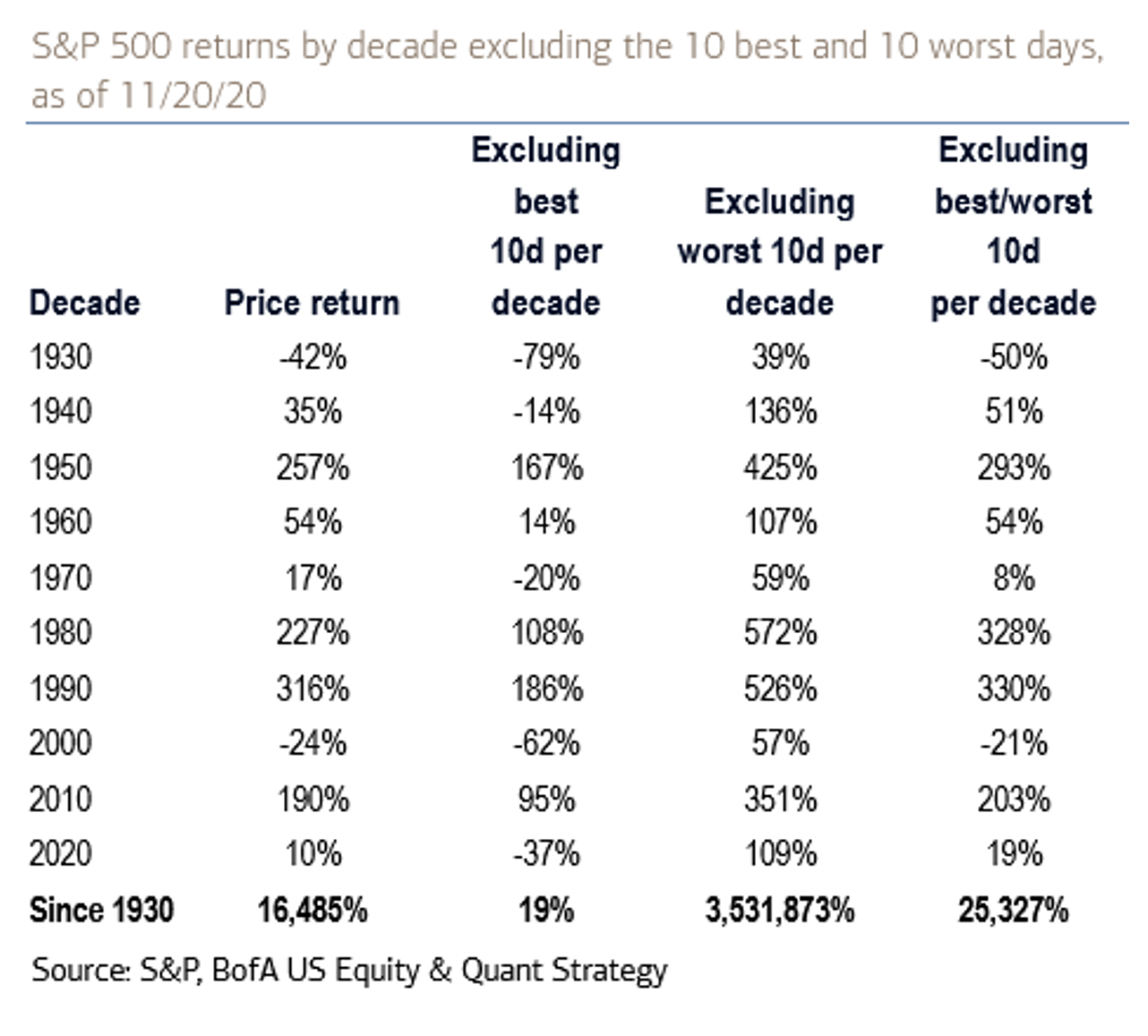

Rule 2: Avoid Panic-Selling – Market timing is difficult. The best days usually follow the worst days for the market. Since the 1930s, if an investor sat out the 10 best return days per decade, that investor’s return would be just 19% compared to the >16,000% returns since then.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Securities offered through Triad Advisors, LLC. Member FINRA/SIPC.

Clearing, custody or other brokerage services may be provided by Fidelity Brokerage Services LLC or National Financial Services LLC. Member NYSE, SIPC

Investment advisory services & insurance services offered through Sugarloaf Wealth Management LLC, a Registered Investment Advisor not affiliated with Triad Advisors LLC or Fidelity Investments, Inc.