Emotional Investing: Right or Wrong?

Last time I checked we are all humans, which means we all have emotions. These emotions are the driving factor behind all decision making. In most circumstances, letting your emotions guide the choices you make is not a bad idea, however, when it comes to your investment portfolio, emotional decision making is an absolute no-go!

We are currently living in one of the most volatile periods in market history. The mass hysteria surrounding COVID-19 and it’s resulting economic impact has been an emotional rollercoaster, to say the least. But like we eluded to above, when it comes to your portfolio, an emotional investment decision during a time like this could adversely affect your entire portfolio.

So, what emotions affect your investment decision making?

• Excitement: believing a certain investment will continue to perform well

• Fear: believing market prices are going to decline

• Optimism: believing that your current plan will always be a good fit

• Anxiety: may control your ability to make rational decisions

What causes it?

• Market Volatility: the rate at which market prices increase or decrease

• Hearsay: excitement or trepidation about a specific investment based on what others are saying

What are the costs?

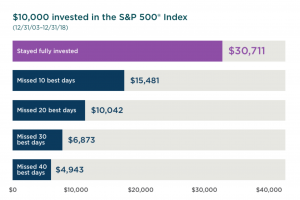

The image below shows how much an account with a $10,000 balance could grow if kept fully invested in the S&P 500. It also shows the growth you could miss out on if you allow emotions to remove your money.

Data is historical. Past performance is not a guarantee of future results. The best time to invest assumes shares are bought when market prices are low.

The easiest way to avoid the pitfalls emotional investing is keeping a good perspective on your long-term plan. Often times short-term noise can cause ‘knee-jerk’ reactions. Do not let these emotions deter you from accomplishing your goals!

If you’d like to meet or speak with one of our advisors about how we can help you avoid emotional investing click here! For the full article click here.