Is a ‘Soft Landing’ Possible?

Is it possible to avoid a recession after a Fed hiking cycle? One thing is for sure – the “upcoming recession” is widely anticipated. We are all looking at the same data, the same information flow, and trying to find historical precedence for what we are going through. We aren’t sure what the near-term future will bring, but here are a few factors that influence whether we have an economic “soft landing” and how that might affect the stock market.

Recessions

Economists have developed a rule of thumb for defining a recession: an economy that experiences two consecutive quarters of declining gross domestic product (GDP). GDP is calculated as:

GDP = Private Consumption + Gross Private Investment + Gov. Investment + Gov. Spending + (Exports – Imports)

The Fed (Federal Reserve Bank) has been raising the Fed Funds rate, the interest rate depository institutions like banks charge each other for overnight loans of funds, from 0.25% in March of 2022 to an expected 5% as on May 3rd. The rate increases are intended to slow the economy enough to reduce the inflation rate. Will the rate increases cause a recession?

Recessions are often accompanied by or caused by shocks. Think about the recessions since 2000.

Common theme? All shocks – all surprise negative events. 2000 and 2008 from bubbles and excessive risk taking, 2020 from widespread economic shutdowns due to COVID.

What shocks have we experienced since 2022 when the Fed began their hiking cycle? We have had our fair share of negative events, but we aren’t sure if the term “shock” or “crises” is appropriate yet.

All of this has occurred while only experiencing a very small technical recession in 2022. So, is that it? Can we still obtain a soft landing, and adjacent to that question, can stocks rise from here?

Earnings Projections are Declining

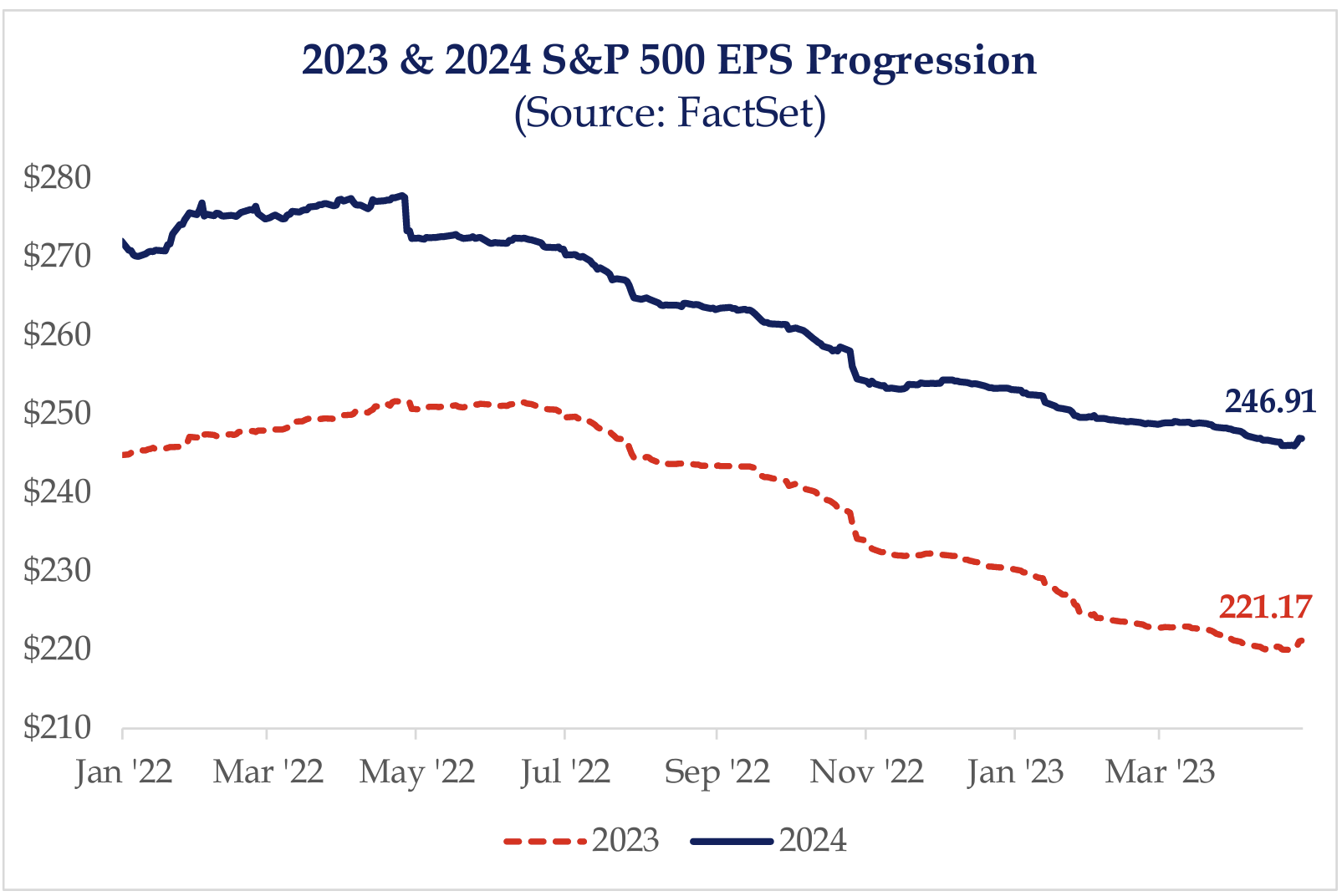

How does the stock market provide returns over time? The price a stock trades at is generally reflective of the price an investor is willing to pay today for receiving a future stream of cash flows. Since stock prices are a function of future cash flows, markets rise over time by having higher future earnings. It’s not so much the absolute amount of earnings per share a company made in the past quarter or year that determines its price but rather the earnings relative to future expectations and the guidance from management that usually propel a stock forward. The chart below shows not only that earnings have declined over the past year (red dotted line) but also that expectations for future earnings have also declined (solid blue line). Current stock prices take into consideration these facts.

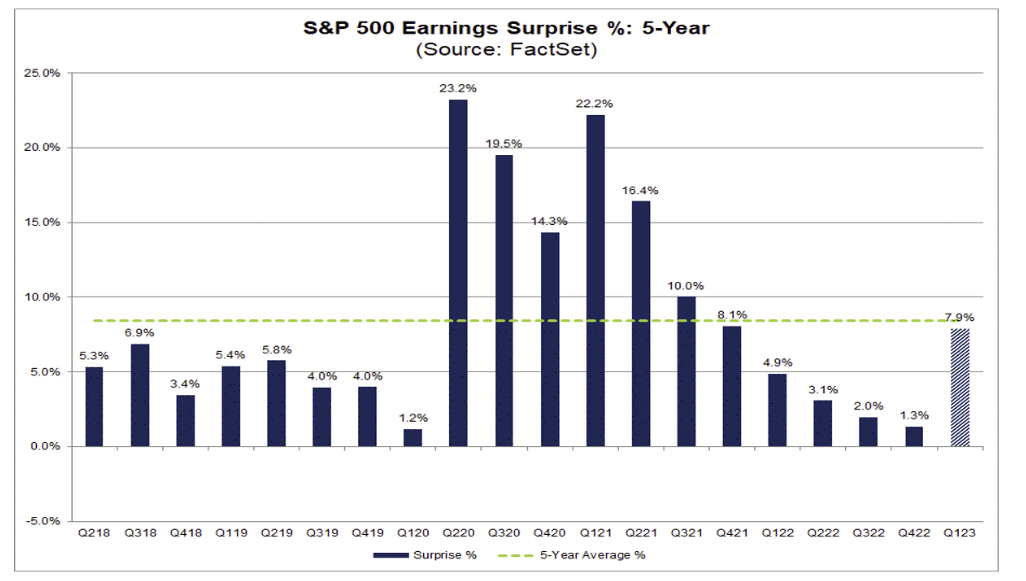

If analyst expectations are declining, shouldn’t it be easier for a company to have an upside surprise on earnings? The Fed’s actions have given corporations ample runway to justify cost cutting, layoffs, strategy shifts, etc. in anticipation of the “coming recession.” Once earnings projections are low enough, companies have a better chance of earnings surprises, which is one of the factors that drive stock prices higher. The chart below shows that earnings surprises so far in Q1 2023 have bounced back close to the historical average (dashed green line).

High Wages – Low Unemployment: The Reason We Haven’t ‘Felt’ a Recession Yet

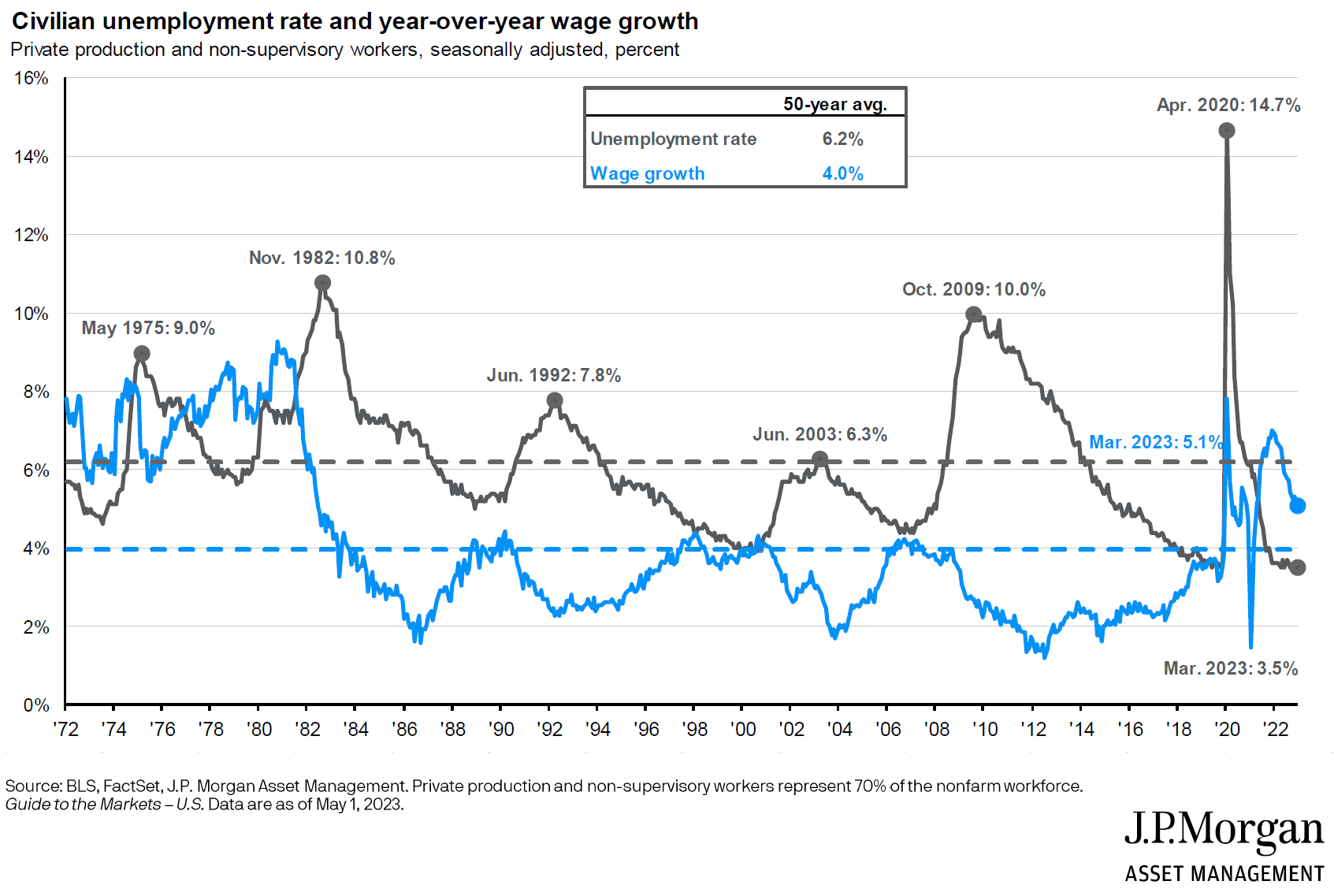

A low unemployment rate may be the buoy that keeps this economy from a hard landing. If the Fed can somehow tame inflation while employment remains strong, it would be a huge win towards a soft landing. But this does seem like wishful thinking. Back in March of 2022, Fed Chairman Powell had his eyes fully focused on the employment market when he said, “Employers are having difficulties filing job openings and wages are rising at the fastest pace in many years. The solution is to bring wages down.”

A few months ago, Powell gave an updated statement on inflation as it relates to wages and unemployment. “We didn’t expect it to be this strong,” Powell said, but it “shows why we think this will be a process that takes quite a bit of time.” He went on to say that the current unemployment rate at 3.4% is at a 53-year low, may be beyond “maximum employment,” and likely would need to rise for inflation to return to the Fed’s 2% target (Reuters).

The chart below shows that the Unemployment Rate remains well below the 50-year average (black dashed line) and Wage Growth remains well above the 50-year average (blue dashed line).

Wages & Unemployment

Market Inflection Points, Recessions, and the Unemployment Rate

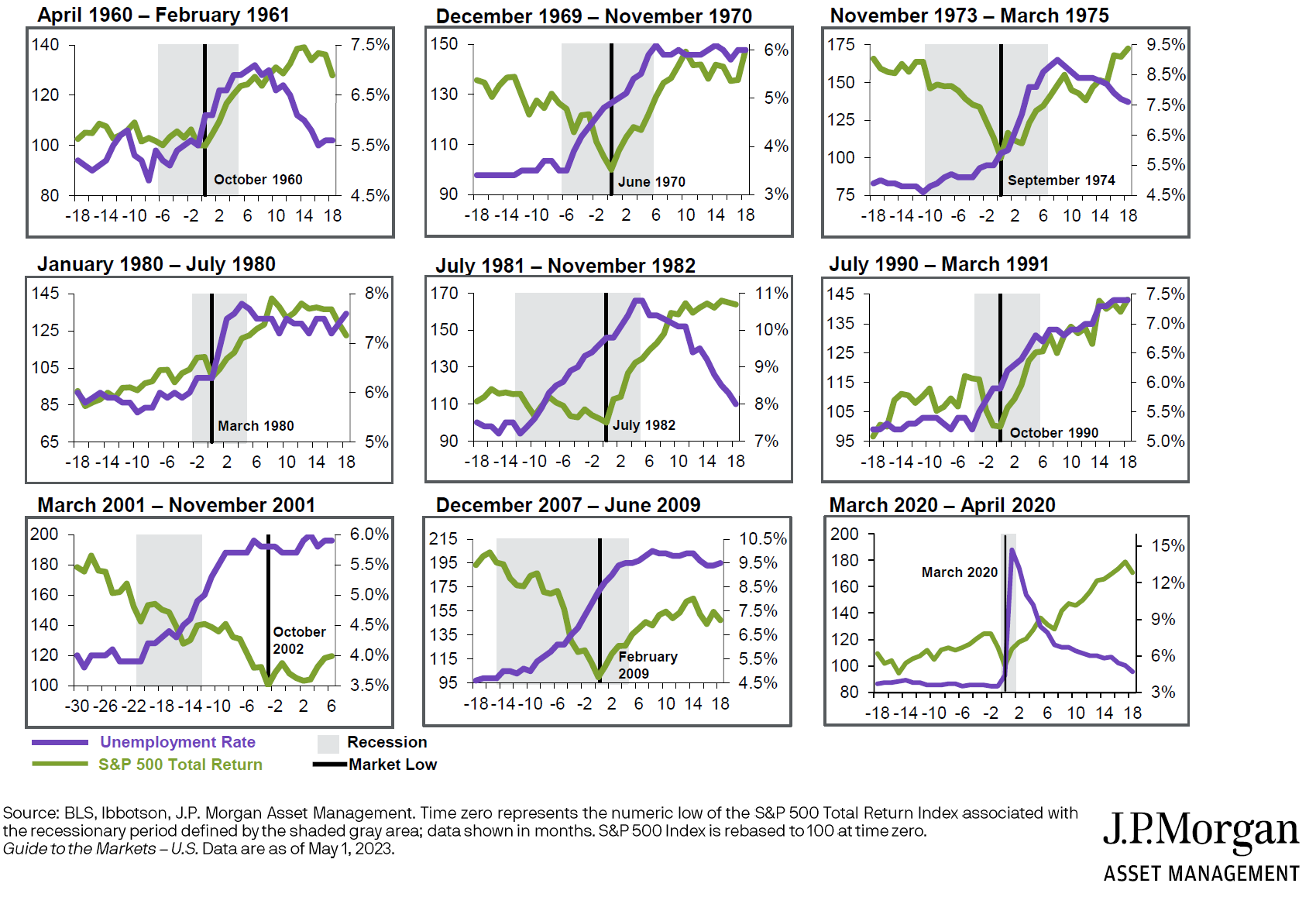

Markets Tend to Bottom Before Recessions are Over – So Don’t Try & Time It

In the charts above, in most cases, unemployment peaked well after the stock market bottom. And the stock market bottoms occurred during the recession. The clear outlier above is the March 2001 – November 2001 recession which included 9/11 and the tech bubble bursting.

Conclusion

Will we have a recession in 2023 or 2024? Are we more likely to revisit the October lows or make new highs above the January 2022 levels? Well, that depends on whether the economy has a soft or hard landing. Inflation is starting to roll over and supply chains are much healthier. Employment remains strong, and so far, corporate earnings have been resilient.

At Sugarloaf Wealth Management, we know the most important factor to your long-term financial health is your financial plan. We want to help you reach your goals in the most efficient way possible. We don’t want you to fear recessions or worry daily about your money. We hope to give you comfort in knowing that your plan has been stress tested against scenarios and market cycles just like the one we are in now (and also ones much, much worse)!

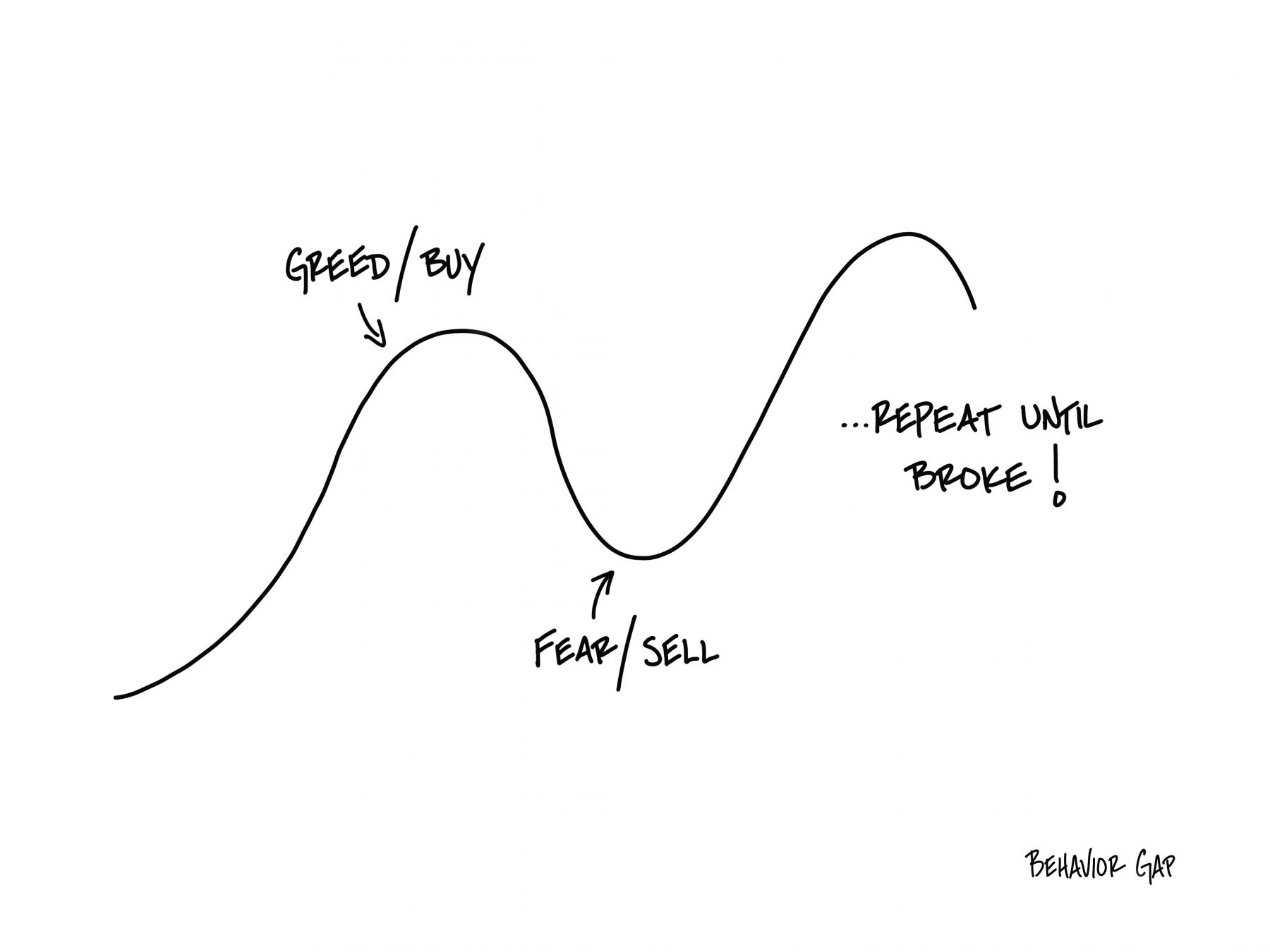

Your returns depend on good investment behavior, time invested, and proper risk management. Carl Richard’s sketch below is what we want to help you avoid: the “Greed / Buy” and the “Fear / Sell”. Will we encounter more fear as we work through the Fed’s tightening cycle? Yes, we think so. But is there long-term opportunity? Yes, there always is.

As always, thank you for your continued trust. Please do not hesitate to reach out if you have any additional questions or concerns.

– Preston Henry, CFP®, CIMA® & Todd Smallwood