Playing the Odds

Experiences shape us to our core. I do not have the data or statistics to support this claim, but I’d be willing to bet that a significant majority of what we learned in life has come from experiences and not information. Experiences shape the way we see things and feel about different people and situations. They can spark overwhelming joy or crippling fear. They can motivate us to take action or push us to retreat in defeat. Experiences create feelings which shape perspectives… and each person’s perspective and experiences are unique to themselves.

Money is a prime example. Every single person on this earth has a slightly different perspective on money. To some money is security and to others money is simply a means to an end. Someone who grew up in poverty or has experienced a parent squander their resources will most certainly view money differently than someone who grew up in a privileged household whose resources were abundant. These experiences, to name a few, shape our perspectives on how we view money, for better or worse…

It is inevitable that at some point in your life you’ve ‘lost’ money. Whether physically, on a bad business deal, an irresponsible purchase, or a poor investment… its happened! There’s no shame in it. But, this, no different than any time before in your life, is an experience that will shape you. In fact, studies show that the loss of resources causes stress which results in the individual becoming highly motivated to conserve their resources. Sounds fair, right? But what evidence has also shown is that these experiences ultimately create a feeling and emotional response. In a 2005 publication titled Risk Uncertainty, researchers found that people are more highly motivated to avoid a loss than they are to seek out and acquire a gain. Essentially, the negative experience of losing money creates negative emotions that end up shaping our perspectives and the decisions that we make.

If you’ve been around our firm at all, you’ve likely heard us say, ‘emotional investing is bad investing’. Letting overly negative (or positive) feelings dictate your decision-making process is a recipe for disaster. – I began this post by stating that experiences are the primary sources of our learned behaviors, but, I did not say it was the best source…

As humans, it is virtually impossible to not let our emotions or perspectives taint our decisions… but we must try! Our best chance at making sound, rational decisions is the reliance upon information.

I realize you did not ask for a psychological break down from a Financial Advisor, so let me tie it all together…

As it relates to investing, we always want to make decisions based on information and not emotions derived from experiences. I realize that we are living in extraordinary times and extraordinary times can create extraordinary emotions. But, its times like these that you must rely on information rather than your feelings to help you navigate this environment. – Historically speaking, we are actually tracking for a pretty average year. Sure, the catalysts and looming issues are different than years past, but the statistics are the similar. Since 1950, the S&P 500 has experienced, on average, a 14% drawdown every year. Over that same period of time the S&P 500 still managed to finish positive 57 of the 71 years.

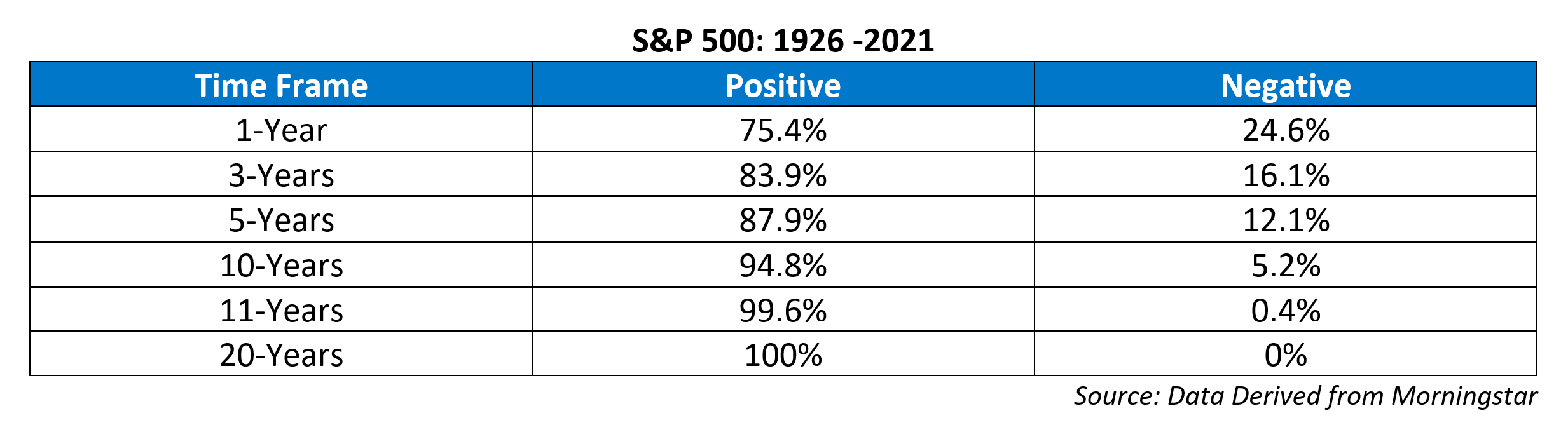

Let me do you one better. Take a look at this chart below. This year has been filled with volatility, but as an investor, its important that you don’t get lost in the day-to-day volatility and instead focus on the bigger picture.

Looking at the bigger picture, you’ll find that the information is skewed in your favor. For example, if you have a 1-year time horizon, the likelihood that the S&P 500 will finish positive is 75% of the time. The longer time horizon, the greater the probability. But, what’s fascinating about this data is that on a daily basis from 1950-2021, the S&P 500 was positive 53.7% of the time and finished negative 46.3% of the time (Crestmont Research). This means that every day there is about a 50/50 chance that you are going to lose money investing. An emotional decision would likely cause you to steer clear altogether, but, with time on your side, a decision based on information could prove incredibly fruitful.

As an investor, we must choose to base our decisions on the information and not our feelings. Morgan Housel, a Fund Manager and NY Times Best Selling Author said it best: “Growth is driven by compounding, which always takes time. Destruction is driven by single points of failure, which can happen in seconds, and loss of confidence, which can happen in an instant.”

Volatility is natural and has been since 1926. Emotions might tell us to flee but the information and statistics show that with time we should embrace it confidently because the odds are ever in our favor.

– Nick Schuessler, CFP®